12M BRC on infrastructure in CHF/EUR/USD

Risk-adjusted investment into the 'hard' infrastructure

On both sides of the atlantic there will be massive infrastructure investments. The US invests 1.2 trillion USD predominently into the 'hard' infrastructure (roads, railways, bridges etc.). A EU-reconstruction foundation holds 800 billion and aproximately the half will be used for the 'hard' infrastructure.

With our 3 underlyings:

- Holcim AG - one of the biggest supplier worldwide in the area of cement, concrete and asphalt

- United Rentals Inc. - the biggest equipment rental company of the world.

- Caterpillar Inc. - The Nr. 1 producer of production machines

you'll invest into the big players of this industry.

Use the current volatility of our underlyings. With our 12M Barrier Reverse Convertible with decreasing Autocall you'll invest in a risk-adjusted way. This product is equipped with a low Barrier (european or american) or the low put strike. The structure is particularly suitable for investors those a direct investment seems to risky. It is also a great and effective diversification option of your portfolio. To provide additional security mechanisms we will construct this product on demand also with the popular One Star- or Lookback-Feature.

The guaranteed coupons exceed the average dividend yields of:

- United Rentals ( - )

- Caterpillar (1.82%)

- Holcim (3.70%)

and provide also a conditional capital protection.

Market opinion:

- weakening prices possible, but not below the barrier level

- sideways trend or slightly rising underlying

12M BRC on infrastructure companies in CHF/EUR/USD

| Maturity | 12 months (early redemption possible) | ||

| Currency | CHF | EUR | USD |

| Denomination | 1000 CHF | 1000 EUR | 1000 USD |

| Underlyings (worst of) | United Rentals (URI US) Caterpillar (CAT US) Holcim (HOLN SW) |

||

| Coupon guaranteed with Low Put Strike 80% |

8.00% p.a. | 8.00% p.a. | 8.90% p.a. |

| Coupon guaranteed with European Barrier 69% |

9.70% p.a. | 9.80% p.a. | 10.60% p.a. |

| Coupon guaranteed with American Barrier 59% |

9.80% p.a. | 9.90% p.a. | 10.70% p.a. |

| Observation | Quarterly | ||

| Autocall | 100% after 3 months then -2% each period | ||

| Indication | 29.09.2021 | ||

| Size (min.) | CHF 250'000;-- | EUR 250'000;-- | USD 250'000;-- |

| Issuer | Rating A- min. | ||

| Issue Price | 100% | ||

| Finders Fee | 1% for You | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers (Best-Execution).

Text and Analysis Florian Franz

Partner Carat Solutions AG

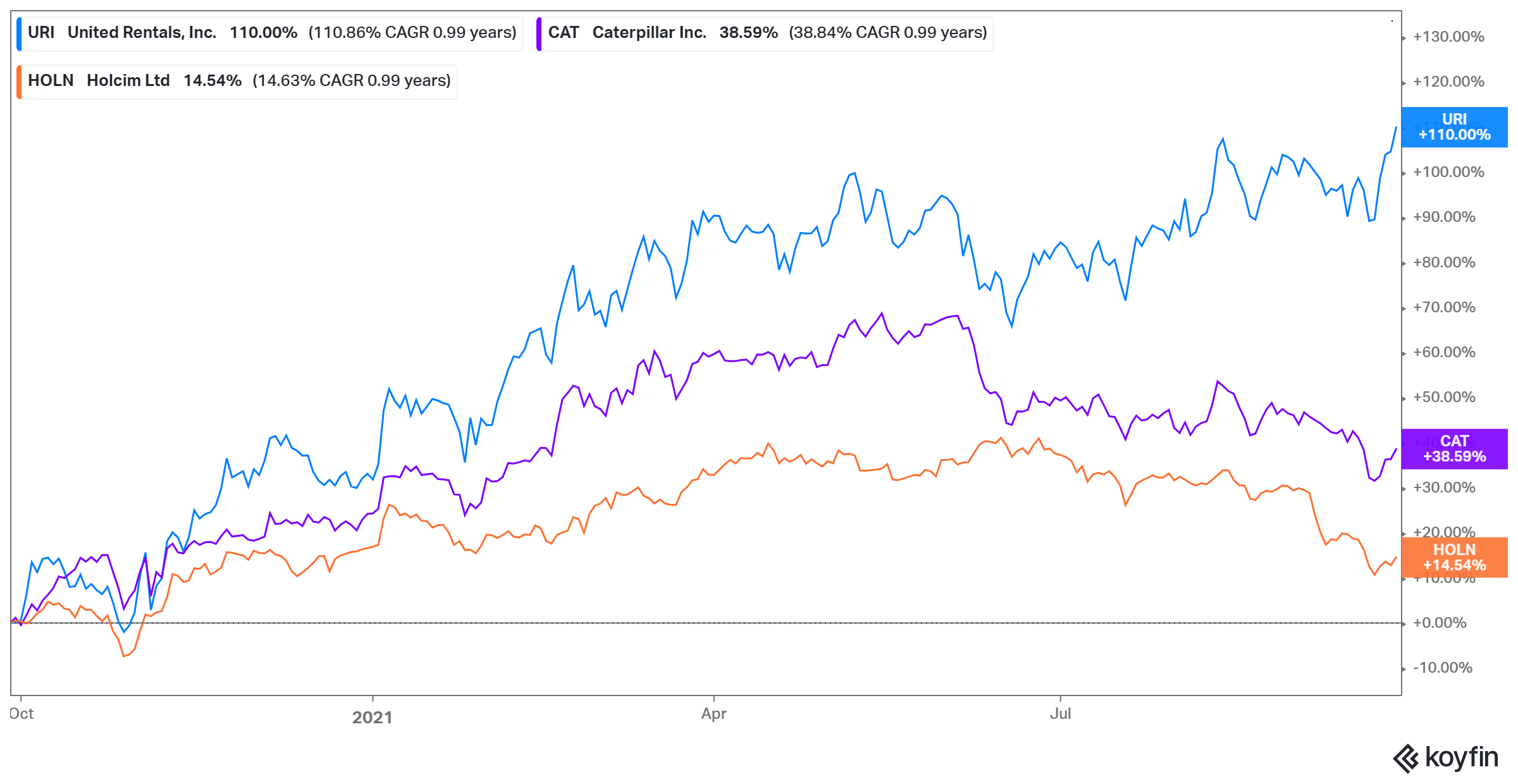

Please find below the chart with the development of the relevant underlyings during the last 12 months: