Week 6: Corona and the Impact on Airlines

Corona and the impact on airlines. Your market opinion in a bearish Barrier Reverse Convertible

Flight cancellations, price declines, strikes and now the Corona virus. The global airlines have a hard time actually. Numerous airlines stop the air traffic into the central realm (China). In contrast to the outbreak of SARS almost 20 years ago the importance of China in the global air traffic increased from 5% to 15%. However, according to the WHO the macroeconomic costs were about 30 billions, which had to be borne by a large portion from the aviation industry. Furthermore the Corona virus seems to spread much faster than SARS. Beside the trade conflicts between the US and the rest of the world this is a further negative factor for the air industry concerns. Even if there is a slight danger for a global epidemic, the prospective security measures will further affect the aviation sector.

We developed a bearish Barrier Reverse Convertible. You assume that the two airlines American Airlines and Air France will increase their market prices less than 25% after 18 months. Independently from that you'll profit from a high guaranteed Coupon. Please note that this product should be used for diversification or hedging of already existing positions in your portfolio since there is large risk when viewed in isolation .

18M Barrier Reverse Convertible Inverse in CHF/EUR/USD

| Currency | CHF | EUR | USD |

| Denomination | CHF 1'000.-- | EUR 1'000 | USD 1'000 |

| Maturity | 18 months (early redemption possible) | ||

| Underlying (Best Of) | American Airlines (AAL US) Air France KLM (AF FP) |

||

| Coupon guaranteed with EU Barrier 125% |

14.75% p.a. | 15.00% p.a. | 16.50% p.a. |

| Autocall | after 6 months 100% | ||

| Observation | Monthly | ||

| Indication | 04.02.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Up on request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Redemption at maturity (Basis is the Best-Of)

| 50% | 100% + Coupon |

| 100% | 100% + Coupon |

| 124% | 100% + Coupon |

| 130% | 70% + Coupon |

| 200% | 0% + Coupon |

| Formel if Barrier Event: MAX(0; Denomination × (200% - Best Performance)) |

| If Best-Of at Autocall Valuation Date <100%; early redemption 100% + Coupon |

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. If this structure doesn't fit to your market opinion we are happy to develop further products for an effective hedging, speculation or arbitrage.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

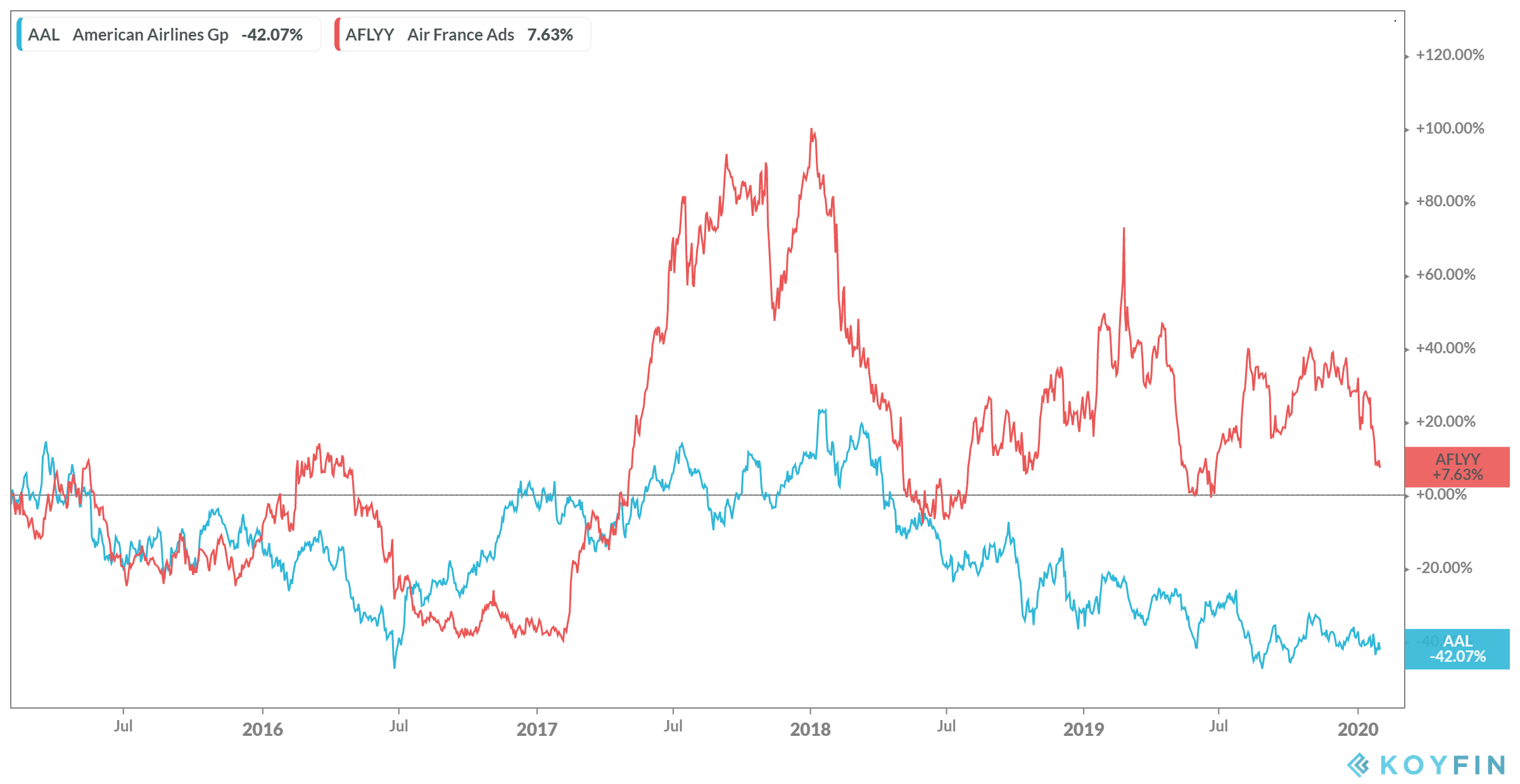

The chart provides you the development of the relevant underlyings during the last 5 years: