Woche 3: Indices and the Lookback Feature

Indices and the Lookback Feature

Do you know this situation? You are close to launch a structured product. In the near future there are some fundamental events (political / economical) which could have at least a short term impact on the financial markets. It is pretty difficult and you need a lot of luck to fix the course at the lowest level. The Lookback feature will increase your chances to come close to this level. As you know ... the deeper the initial course the lower is the opportunity of a barrier event. Depending on time range and number of periods the lookback detects the lowest price level separately for each underlying, which is the basis for the rest of the maturity.

Lookback Feature

- The lowest course level will be detected and therefore the chances of a successful investment will increase

- flexibel maturities and periods (daily/weekly/monthly)

Example: 30M Express Certificate with guaranteed Coupon on Indices with Lookback with 2 or 3 Lookbacks

- Trade Date

- After first month

- After second month (only with 3 Lookbacks)

Those points in time will be considered retrospectively and for each underlying the lowest individual price level will be fixed.

30M BRC on Indices with 2 Lookbacks in CHF/EUR/USD

| Currency | CHF | EUR | USD |

| Denomination | CHF 1'000.-- | EUR 1'000 | USD 1'000 |

| Maturity | 30 months (early redemption possible) | ||

| Underlying (Worst Of) | Russel 2000 Index (RTY) Euro Stoxx 50 (SX5E) FTSE 100 (UKX) SMI 100 (SMI) |

||

| Coupon guaranteed | 4.50% p.a. | 5.00% p.a. | 6.65% p.a. |

| Barrier (continuous) | 67.5% | 69% | 67.5% |

| Barrier (at maturity) | 79.9% | 79.5% | 78.1% |

| Autocall | Starting after Q3 with 100% then each Quarter -1% | ||

| Observation | Quarterly -- 2 Lookbacks (min. Fixing): First at trade date Second after 1M |

||

| Indication | 15.01.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

30M BRC on Indices with 3 Lookbacks in CHF/EUR/USD

| Currency | CHF | EUR | USD |

| Denomination | CHF 1'000.-- | EUR 1'000 | USD 1'000 |

| Maturity | 30 months (early redemption possible) | ||

| Underlying (Worst Of) | Russel 2000 Index (RTY) Euro Stoxx 50 (SX5E) FTSE 100 (UKX) SMI 100 (SMI) |

||

| Coupon guaranteed | 4.50% p.a. | 5.00% p.a. | 6.65% p.a. |

| Barrier (continuous) | 71.5% | 71.5% | 71.5% |

| Autocall | Starting after Q3 with 100% then each Quarter -1% | ||

| Observation | Quarterly -- 3 Lookbacks (min. Fixing): First at trade date Second after 1M 3rd after 2M |

||

| Indication | 15.01.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

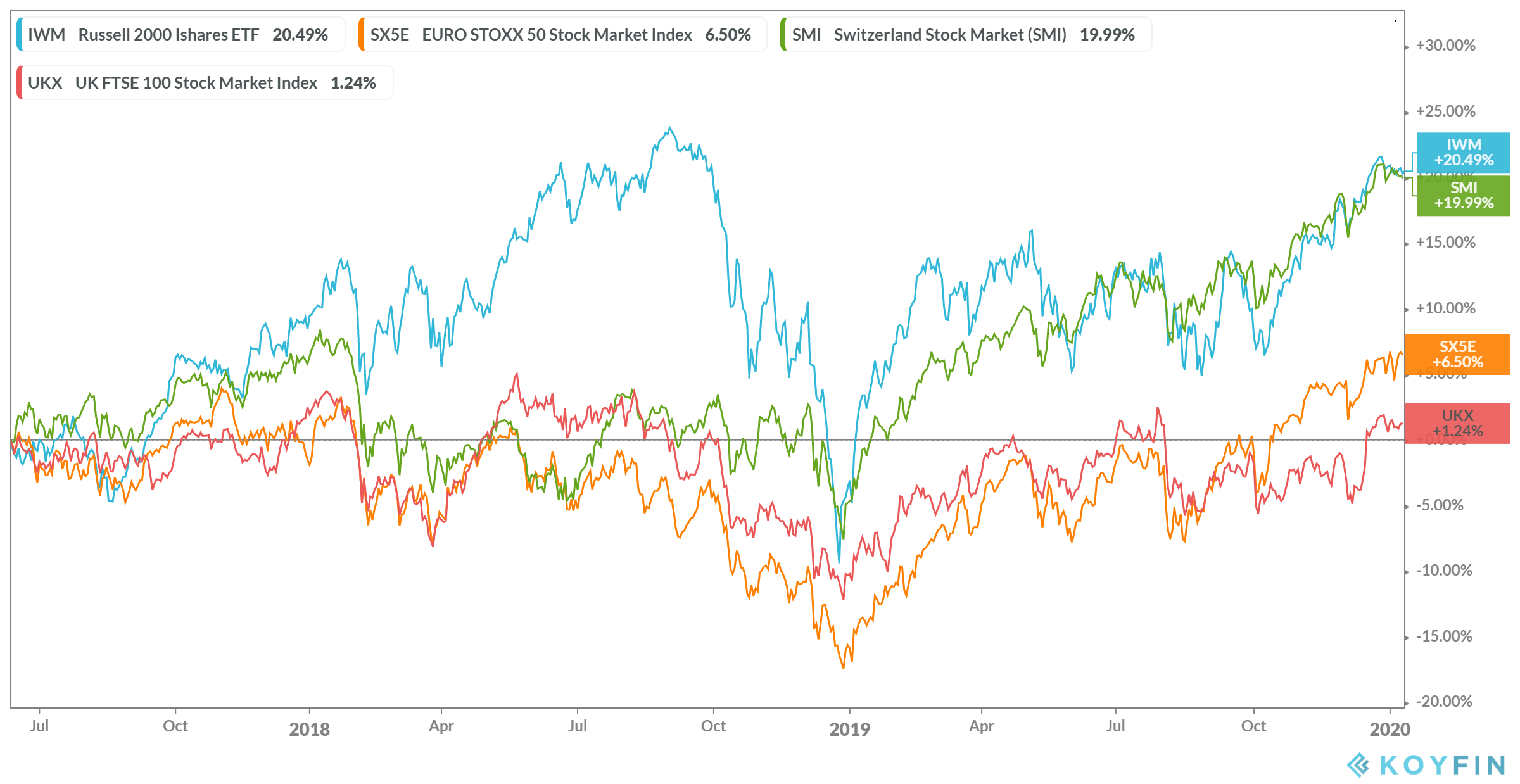

The chart provides you the development of the relevant underlyings during the last 30 months: