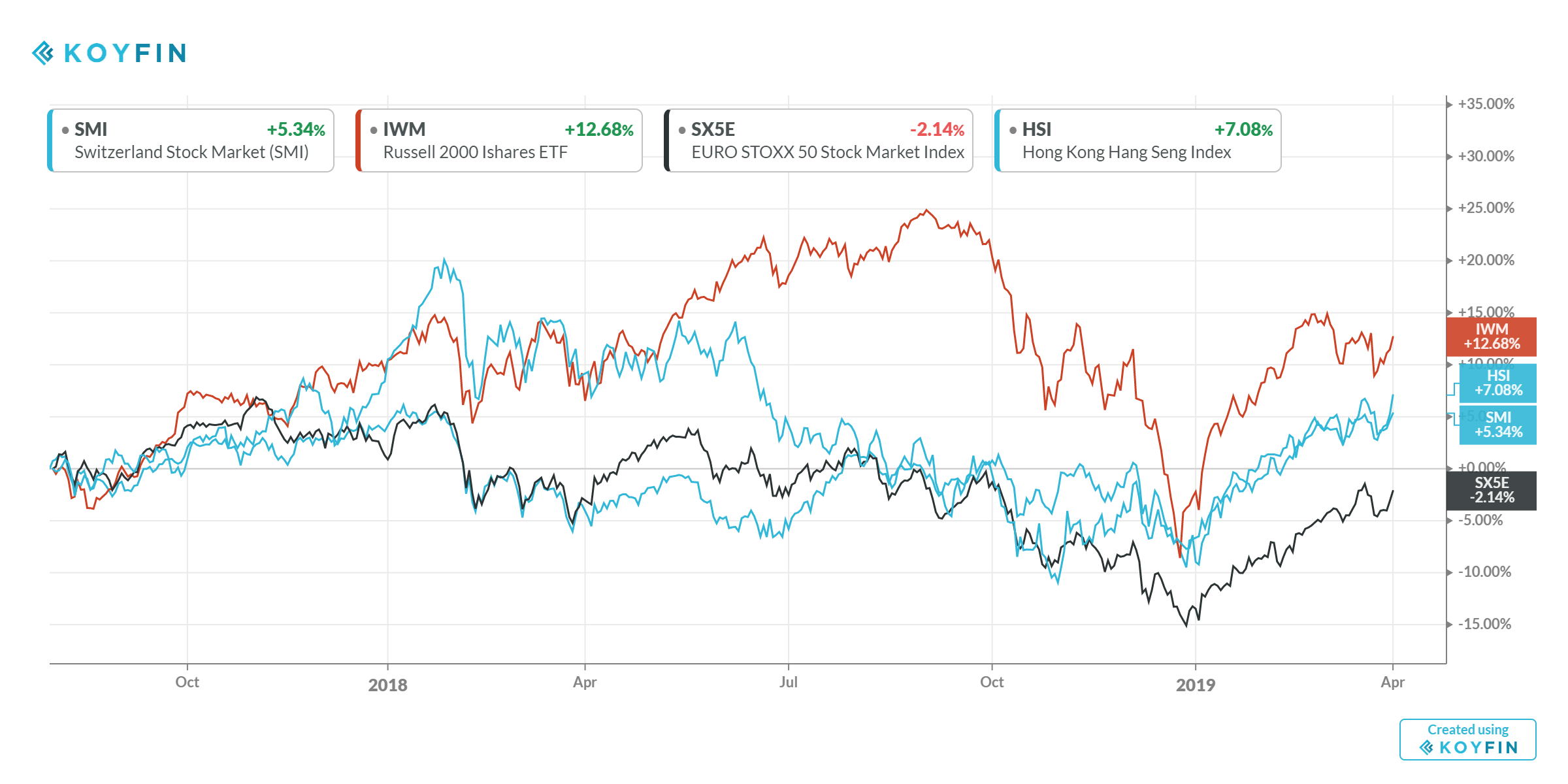

Week 14: Western Indizes and China

This week we focus on large diversified Indizes (EuroStoxx 50, Russell 2000, SMI and Hang Seng) with lower volatility compared to direct invesments in companies but still paying very attractive Coupon (5.20% in CHF, 5.50% in EUR and 8.20% in USD). The Decreasing Autocall mechanism (from 100% to 85%) multiply chances to be redeemed earlier (quarterly observation), in sideway to slightly decreasing markets.

The whole product is build with a conditional Barrier of 69% with monitoring at maturity (European option).

INDICES:

- Hang Seng Index: Diversified Index composed by the 50 largest companies quoted in Hong-Kong

- Russell 2000: Contains the 2000 last companies contained in the Russell 3000

- Euro Stoxx 50: Composed of the 50 largest european companies

- SMI: Represents the 20 largest swiss comapnies

We cannot yet exclude any further market correction, therefore we built our Barrier Reverse Convertible with a maturity if 18 months maximum, a european barrier of 69% and a very attractive Coupon (5.20% en CHF, 5.50% en EUR et 8.20% en USD). The product has been specially designed to navigate on sideways to slightly decreasing markets.

18M BRC on Indices in USD/EUR/CHF Quanto

|

Currency |

USD/EUR/CHF Quanto |

|

Denomination |

[CCY] 1'000.-- |

|

Maturity |

18 months (early redemption possible) |

|

Underlyings (Worst-Of) |

Hang Seng China Enterprise Indices (HSCEI IND) |

|

Version |

Standard |

|

Coupon guaranteed |

8.20% p.a. (USD) |

|

Autocall |

After Q1: No Autocall |

|

Observation |

after 6 months |

|

Barrier |

69% (european) |

|

Indication |

03/04/2019 (11.30 a.m.) |

|

Size |

[CC] 1'000'000.-- |

|

Issuer |

Rating A minimum |

|

Issue Price |

100% |

|

Finders Fee |

up on request |

Don't hesitate to contact us in order to set your own structure.

Many thanks for your visit on our Website!