Week 15: Running against the crisis

Adidas, Nike and Asics as Outperformance- and with the structure of an Express Certificate

Closed shops, cancelled sport events and additionally the threat of adidas not to pay the rent for their shops (not implemented). The big sporting goods manufacturers don't have it easy and have been dragged down from the corona crisis. Actually it seems that the markets found their bottom formations and are now trending up. In our investment idea of week 15 we developed two interesting products with the two biggest sporting goods manufacturers, Nike and Adidas, as well as Asics, the producer of the worldwide best running shoes. Running is trend and is gaining more and more fans.

The Outperformance Certificate is aimed to investors who assume that there will be significant rising rates of the underlyings within the maturity. These investors like to use this situation with a leveraged product. This certificate is further equipped with reduced participation (75%) in case of decreasing prices.

6M/12M/18M Outperformance Certificate on Sport Manufacturer in CHF

| Maturity | 6 months | 12 months | 18 months |

| Currency | CHF | ||

| Denomination | 1000 CHF | ||

| Underlying (Worst Of) | Adidas (ADS GR) Asics (7936 JP) Nike (NKE US) |

||

| Participation up | 333% | 352% | 378% |

| Participation down | 75% | 75% | 75% |

| Indication | 09.04.2020 | ||

| Size | CHF 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Up on request | ||

Redemption (12M)

| Performance worst-of | Redemption |

| +50% | 276% |

| +20% | 170,4% |

| +-0 | 100% |

| -25% | 81,25% |

| -50% | 62,50% |

The Express Certificate is aimed to investors which would like to benefit from memory coupons within the maturity. These investors are uncertain about the precise development of the underlyings. Therefore this risk adjusted structure is equipped with a low european barrier 59% and a decreasing autocall level to increase the probability of an early redemption.

6M/12M/18M Express Certificate on Sport Manufacturer in CHF

| Maturity | 6 months | 12 months | 18 months |

| Currency | CHF | ||

| Denomination | 1000 CHF | ||

| Underlying (Worst of) | Adidas (ADS GR) Asics (7936 JP) Nike (NKE US) |

||

| Coupon Memory with European Barrier 59% |

10.96% p.a. | 14.30% p.a. | 14.40% p.a. |

| Coupon Barrier | 69% | ||

| Observation | Quarterly | ||

| Autocall | after 3 months 100% each quarter decreasing -2% | ||

| Indication | 09.04.2020 | ||

| Size | CHF 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Up on request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

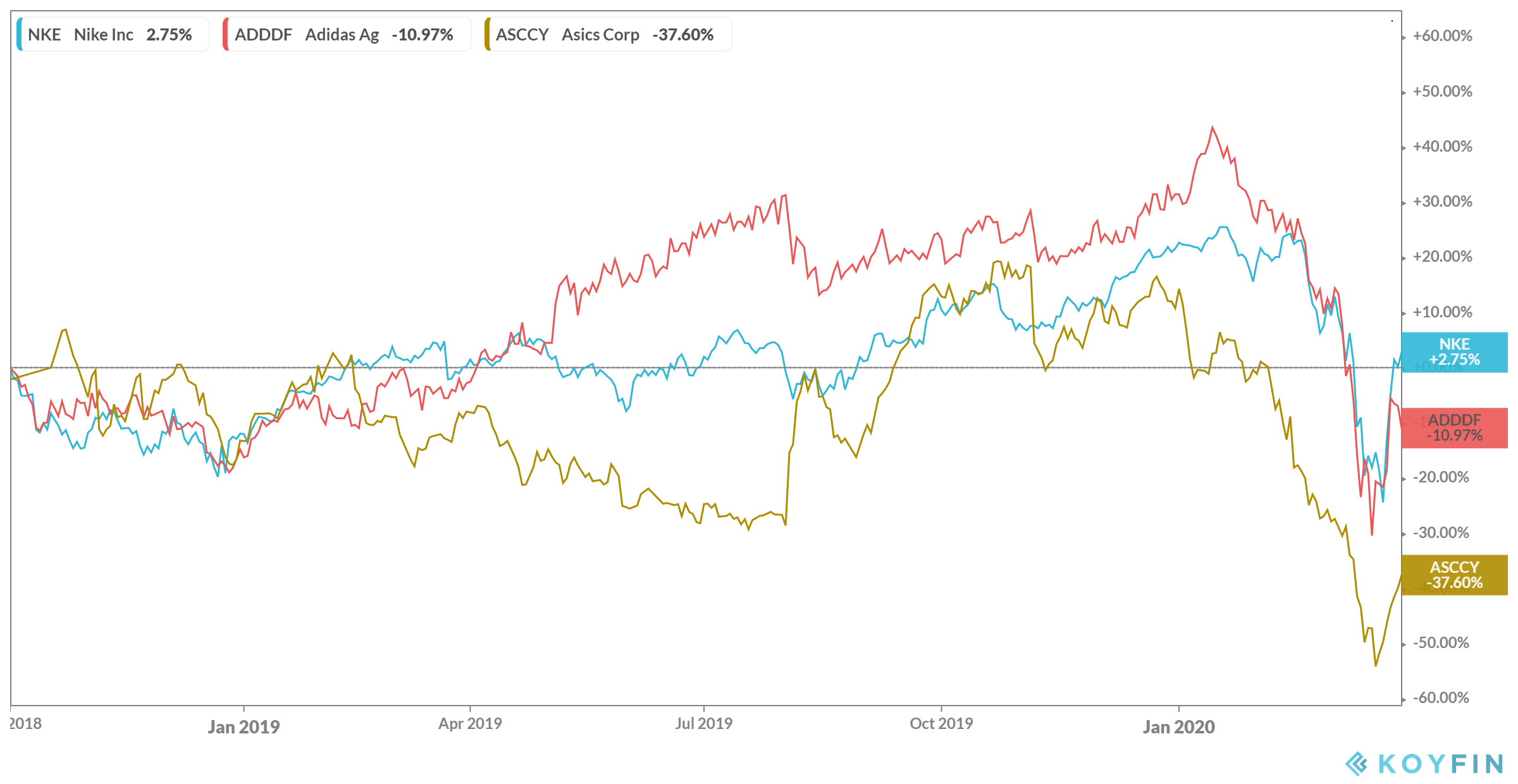

Please find below the chart with the development of the relevant underlyings during the last 18 months: