Week 18: Twin Win on Indices

Use all market movements with your TWIN WIN on Indices

Our 24M TWIN WIN on selected indices enables you to reach positive performance in case of increasing prices (up to the cap) as well as in case of decreasing prices (up to the barrier). To keep safety also at rapid volatility moments we implemented a european barrier in all our products.

If your market opinion is similar as the following, our TWIN WIN Certificates are the best way to hedge your portfolio and make it more efficient:

You're not sure about the impact of Corona on the economies and financial markets. Simultaneously you think that your favourite index will have another level, within a certain range (Cap/Barrier), in 24 months. This product is a great tool to diversify and hedge your existing portfolio. Negative developments will be converted, up to the barrier, into positive returns.

We selected the following indices*:

- Euro Stoxx 50 (SX5E) The broad diversified index conists of the 50 most capitalized companies in europe

- S&P 500 (SPX) One of the most important index worldwide includes the 500 biggest companies in terms of capital

- Nasdaq 100 (NDX) The 100 most capitalized companies from NASDAQ- non financial companies

- Russel 2000 (RTY) One of the most important index for small-medium caps includes the 2000 smallest companies from the Russel 3000

- iShares STOXX Global Select Dividend (SDGP) The 100 leading global companies in terms of dividends

- Swiss Market Index (SMI) The 20 biggest companies in switzerland

- CAC (CAC) The 40 biggest companies in france

* please note that indices can be replicated (in consultation) by equivalent ETF's

24M TWIN WIN on different Indices

| Currency | EUR | EUR | CH | USD | USD | USD | USD | CHF |

| Denomination | [CCY] 1'000 | |||||||

| Maturity | 24M | |||||||

| Underlying | SX5E | DAX | SMI | SPX | RTY | NDX | SDGP | SDGP |

| Barrier (european) | 78% | 77% | 80% | 76% | 75% | 77% | 75% | 77% |

| Cap | 130% | 120% | 120% | 130% | 125% | 120% | 125% | 120% |

| Participation up | |100%| up to the cap | |||||||

| Participation down | |100%| up to the barrier | |||||||

| Strike | 100% | |||||||

| Indication | 29.04.2020 | |||||||

| Issuer | Rating A- minimum | |||||||

| Size | [CCY] 1'000'000;--- | |||||||

| Issue Price | 100% | |||||||

| Finders Fee | up on request | |||||||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Redemption at maturity (Bsp. SPX):

| S&P 500 | +35% | +10% | -10% | -23% | -40% |

| Auszahlung Twin Win | +30% | +10% | +10% | +23% | -40% |

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. .

Text und analysis Florian Franz

Partner at Carat Solutions AG

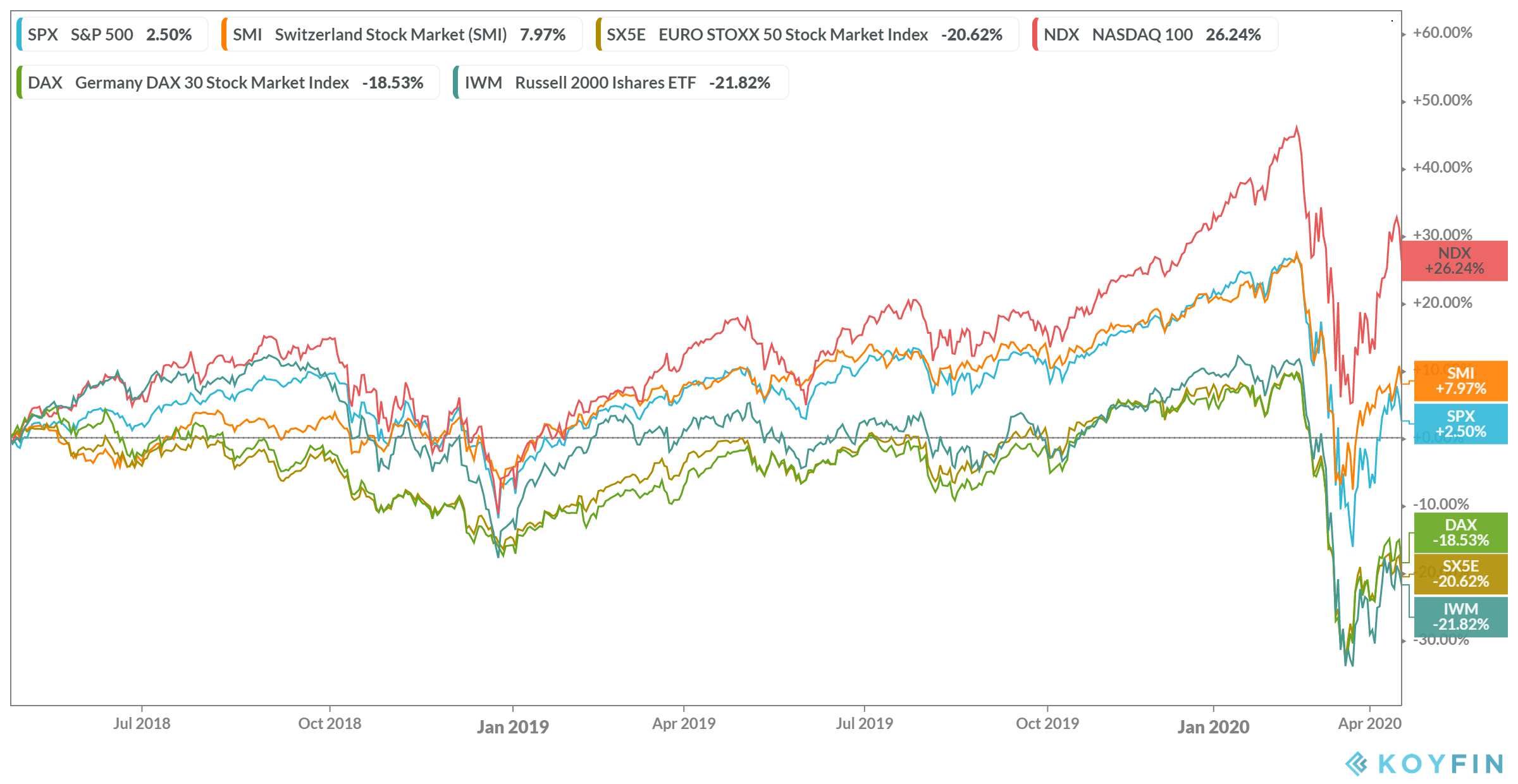

The chart provides you the development of the indices during the last 24 months