Credit Derivatives

Reference Entity Certificate with Conditional Capital Protection

There are many different types of credit derivatives including credit default swaps (CDS), collateralized debt obligations (CDO), total return swaps, credit default swap options and credit spread forwards. In exchange for an upfront fee, referred to as a premium, banks and other lenders can remove the risk of default entirely from a loan portfolio. As an example, assume company A borrows CHF 100'000.-- from a bank over a 10-year period. Company A has a history of bad credit and must purchase a credit derivative as a condition of the loan. The credit derivative gives the bank the right to "put" or transfer the risk of default to a third party. In other words, in exchange for an annual fee over the life of the loan, the third party pays the bank any remaining principal or interest on the loan in case of default. If company A does not default, the third party gets to keep the fee. Meanwhile, company A receives the loan, the bank is covered in case of default on company A, and the third party earns the annual fee. Everyone is happy.

Market expectation

- Rising underlying

- Sharply falling underlying possible

- No credit event of the reference entity

Characteristics

- There are one or more reference entities underlying the product

- In addition to the credit risk of the issuer, redemption is subject to the solvency (non-occurrence of a credit event) of the reference entity

- Redemption is made at least in the amount of conditional capital protection at maturity, provided that no credit event of the reference entity has occurred

- If a credit event occurs at the reference entity during the life time, the product will be redeemed at an amount corresponding to the credit event

- The product value can fall below conditional capital protection during its lifetime, among other things due to a negative assessment of reference issuer creditworthiness • Conditional capital protection only applies to the nominal and not the purchase price

- Participation in development of the underlying, provided a reference entity credit event has not occurred

- The product allows higher yield at greater risk

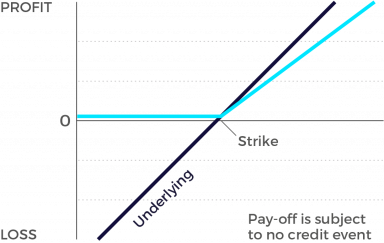

Graphic

Reference entity certificates are products whose basic structure is optimized with the addition of a corporate or government bond (reference bond) with a comparable maturity. This means that, in addition to the issuer risk, the redemption of the product is also subject to the solvency of the reference entity (i.e. the non-occurrence of a credit event). The product's risk is therefore dependent in part upon the creditworthiness of the reference entity. This higher risk is rewarded with better terms, such as higher coupons and greater participation rates. The credit quality may change during the lifetime of the product, and this influences the price of the product on the secondary market. If a credit event occurs (i.e. the reference entity becomes insolvent during the lifetime of the product), the product becomes due prematurely. Investors are then credited with an amount per product, based on the market value of the reference bond at the time insolvency was declared. In practical terms, this means that investors may lose most or all of the money they have invested if such an event takes place. Most reference entity certificates are collateral-secured instruments (COSI products) which eliminate the default risk of the individual product issuer almost entirely.