Yield Enhancement

Express Certificate

Many Investment Products aimed at optimizing yields offer partial protection. This can provide attractive returns even when the price of the respective underlying asset just remains stationary up to maturity. Since the capital protection is often conditional (e.g. in the form of a barrier) or is only partially provided (e.g. in the form of a price reduction), loss of invested capital may nonetheless occur on maturity. In addition, the opportunity for yield that is expected is often limited to a maximum return.

Market expectation

- Underlying will not breach barrier during product lifetime/at maturity

- Underlying moving sideways or slightly rising

- Decreasing volatility

Characteristics

- Should the underlying trade above the strike on the observation date, an early redemption consisting of nominal plus an additional coupon amount is paid

- With higher risk levels, multiple underlyings allow for higher coupons or lower barriers

- Offers the possibility of an early redemption combined with an attractive yield opportunity

- Reduced risk compared to a direct investment into the underlying

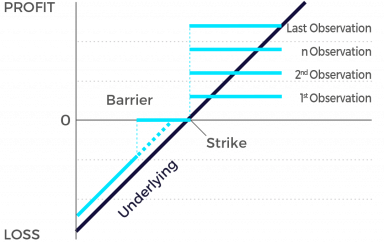

Graphic

At the time they’re issued, classical “express” certificates normally have a maximum term to maturity of something between 3 and 6 years. For each year, a predetermined “observation day” is set. If on the observation day the price of the underlying instrument is at or above a specified threshold level, the certificate is redeemed prematurely. This means that you’ll receive an early payback of your investment with a total return that generally lies in the area of 5 to 8 percent on an annualized basis.

If on the other hand the underlying instrument is trading below the threshold level on the observation day, the certificate will continue to run until the next observation day. If the threshold level is never breached on any observation day during the certificate’s term to maturity, you’ll normally receive repayment of the issuance price, provided the underlying instrument hasn’t fallen below a stipulated safety threshold. Were the latter to be the case, you’d incur a loss at maturity.

Classical express certificates are best suited to investors who are looking for the market to trade sideways or slightly higher.