Risk-adjusted investments on Bitcoin

BRC and Outperformance on Bitcoin

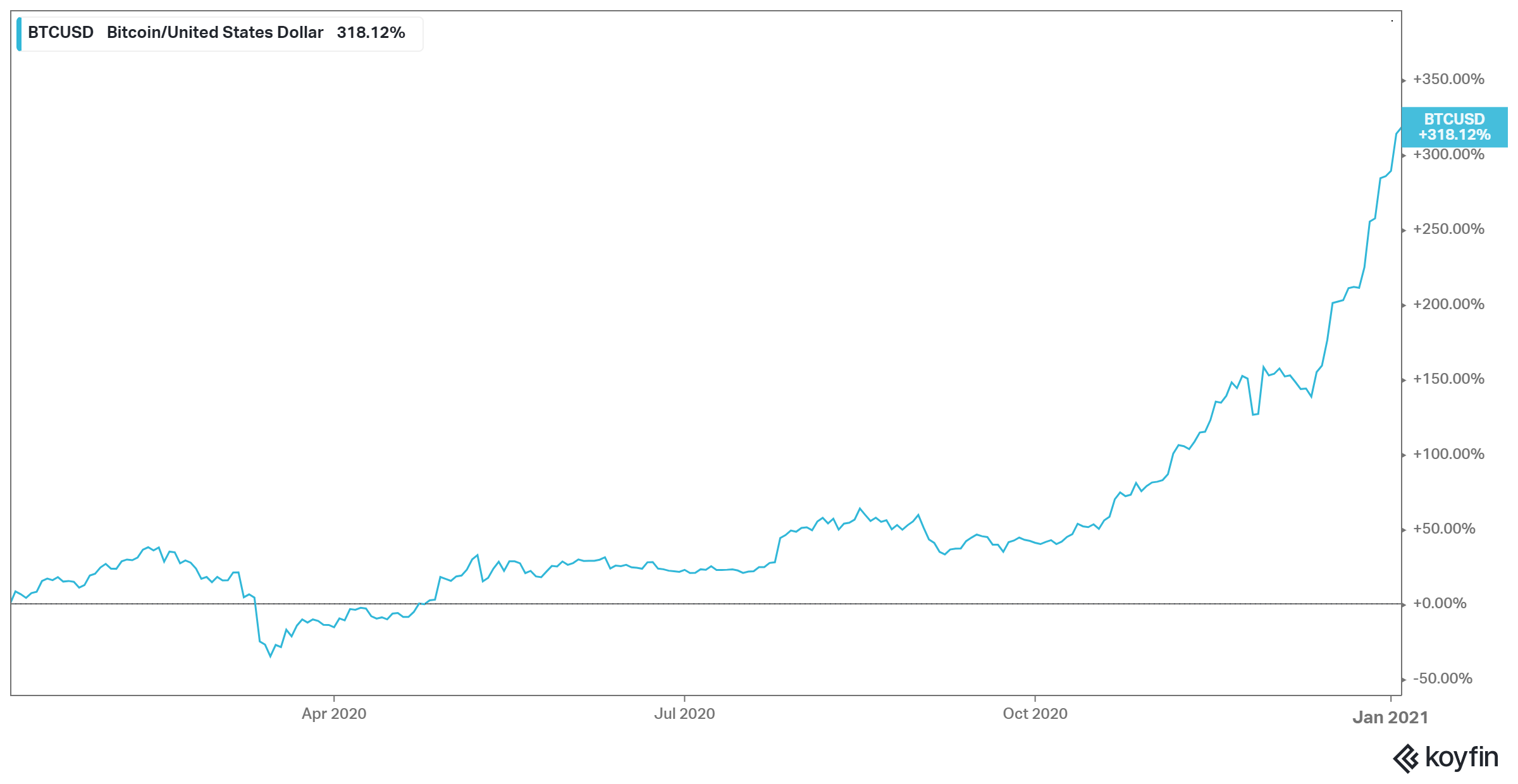

Last sunday the Bitcoin hit the new high of 34.000 USD on his 12th anniversary. Not only for this reason the most famous cryptocurrency is indispensable in todays financial markets. Numerous financial institutions and investment managers use the bitcoin to hedge the risks in a fragile monetary system and a distortious financial market. The high additional debts due to corona could further enhance the demand. Pay Pal enable clients actually to use the Bitcoin for transactions.

Advantages of the Bitcoin:

- the expansive monetary policies will have a negative impact on the stability of the currencies - inflation protection

- less correlation with other asset classes - great diversification probabilities

- benchmark and pioneer of all cryptocurrencies

- the number of bitcoins is limited (21 MIO)

To mark the start of 2021 we have developed a Barrier Reverse Convertible and an Outperformance Certificate to provide risk-adjusted investment opportunities for the Bitcoin. Both products have a short maturity of 3 months. Whereas the investors of the BRC consider sideway markets the Outperformance Certificate is made for investors who will profit from increasing courses with a leverage effect.

3M Barrier Reverse Convertible on Bitcoin in USD

| Maturity | 3 months (early redemption possible) | ||

| Currency | USD | ||

| Denomination | 1000 USD | ||

| Underlying | Bitcoin (BTC USD) | ||

| Coupon guaranteed with European Barrier 69% |

43.00% p.a. | ||

| Coupon guaranteed with European Barrier 56% |

18.00% p.a. | ||

| Observation | Monthly | ||

| Autocall | 100% after 1 month | ||

| Indication | 06.01.2021 | ||

| Size | min. USD 100'000;-- | ||

| Issuer | tbc. | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

3M Outperformance Certificate on Bitcoin in USD

| Maturity | 3 months | ||

| Currency | USD | ||

| Denomination | 1000 USD | ||

| Underlying | Bitcoin (BTC USD) | ||

| Participation up | 200% | ||

| Participation down | 100% | ||

| Cap | 120% | ||

| Redemption | max. 140% | ||

| Indication | 06.01.2021 | ||

| Size | min. USD 100'000;-- | ||

| Issuer | tbc. | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

Redemption at maturity

| Performance Underlying | Redemption |

| +50% | 140% |

| +20% | 140% |

| +10% | 120% |

| +-0% | 100% |

| -20% | 80% |

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

Please find below the chart with the development of the relevant underlyings during the last 12 months: