Week 21: Shark Note on Gold

Hedging with a Shark Note on Gold

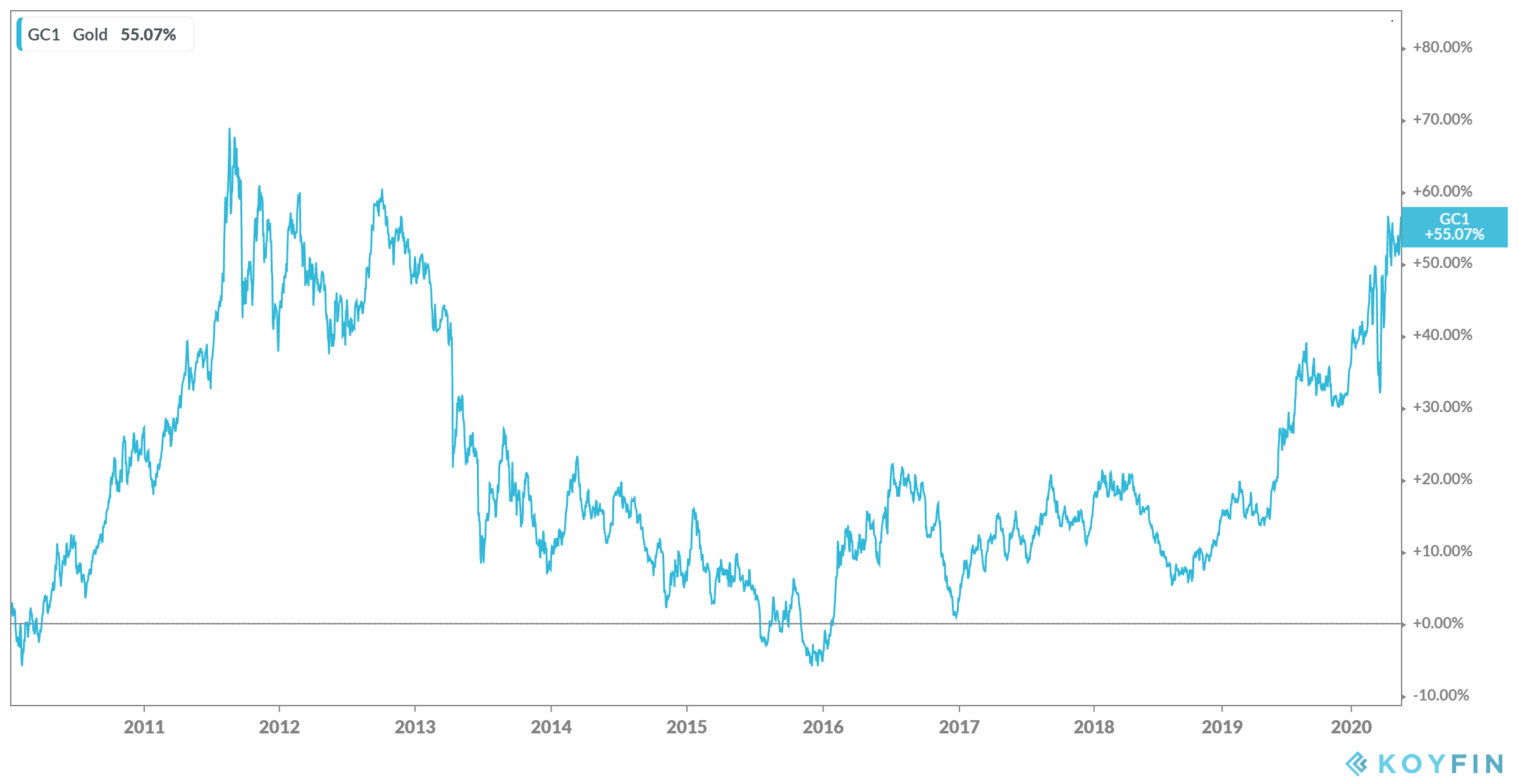

Gold has shown a great performance in the last years. Since 2016 there is an increase around 60%. The chart (see below) illustrates the development during the last 10 years. The current formation reminds on the period from 2011/2012, when the historic maximum was reached. Subsequently the prices fell 70% up to 2017. So there are some indications for hedging on the actually high level.

This week we present you the hedging opportunity (two versions) with a Shark Note. The shark note is an interesting alternative to the well-known Capital Protection Note.

If the following scenarios are propable for you this product is an excellent option:

Market expectation:

- moderate growth, which won't reach 20% (Knock-In) over the period

- short-term and long-term setbacks possible

Redemption:

Denomination x (Capital Protection + Participation x (Final Fixing Level – Strike) / Initial Fixing Level)

- If the price during the period (end of day)>100% and <120% then redemption (mind. 100%) max. 119,9%

- If the price at maturity <95% = 95%

- In case of a Barrier Event = 104%

18M Shark Note 95% on Gold in USD

| Currency | USD | ||||

| Denomination | USD 1000 | ||||

| Underlying | Gold (XAU CUR) | ||||

| Maturity | 18 months | ||||

| Capital Protection | 95% | ||||

| Participation up | 100% (up to the Knock-In-Barrier) | ||||

| Barrier (Knock-In) | 120% (end of day) | ||||

| Indication | 20.05.2020 | ||||

| Strike | 95% | ||||

| Issuer | tbc. | ||||

| Issue Price | 100% | ||||

| Finders fee | up on request | ||||

A modified version of the product above constructs the following Shark Note. Due to a participation of 200% we reach substantially higher payout options. Therefore the capital protection will be reduced to 90% and the strike is now 100%. In case of a barrier event the payout is 110%.

Redemption:

Denomination x (Capital Protection + Participation x (Final Fixing Level – Strike) / Initial Fixing Level)

- Max. redemption 143,99%

- If the price at maturity <95% = 95%

- In case of a Barrier Event = 104%

*please considerthat the underlying has to increase 5% to reach the Break Even Point 5% x (200% Participation) = 10% (see also payout formula)

18M Shark Note 90% auf Gold in USD

| Currency | USD | ||||

| Denomination | USD 1000 | ||||

| Underlying | Gold (XAU CUR) | ||||

| Maturity | 18 months | ||||

| Capital Protection | 90% | ||||

| Participation up | 200% (up to the Knock-In-Barrier) | ||||

| Barrier (Knock-In) | 122% (end of day) | ||||

| Indication | 20.05.2020 | ||||

| Strike | 100% | ||||

| Issuer | tbc. | ||||

| Issue Price | 100% | ||||

| Finders fee | up on request | ||||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

Please find below the chart with the development of the relevant underlying during the last 10 years: