Week 9: Cyber Security

Riskadjusted Investments in Cyber-Security

The cyber security industry is steadily growing. In times of expanding digitalisations the demand for adequate protections is simultaneously growing.

What is Cyber Security?

Cyber-Security is the science of the save storage of digital datas, and this only in the hand of those, who should really have access. Traditionelly Cyber-Security consists of a hardware, which is designated a firewall as part of a business-server. A firewall controls and decides, which datas in and from the network are authorized. Imagine the security checks at the airport. Employees are now able to to have an access from everywhere to the business applications, which leads to a complicated security risk, that makes the firewall in the office obsolete. The customers put more and more datas online when they make business with companies. The quantity of datas in the internet is strongly increasing. The same holds for the necessity to save all these datas. Researches from Global Market Insights shows that the whole Cyber-Security-Branch will grow about 12% in average per year and will be worth 300 billion USD in 2024.

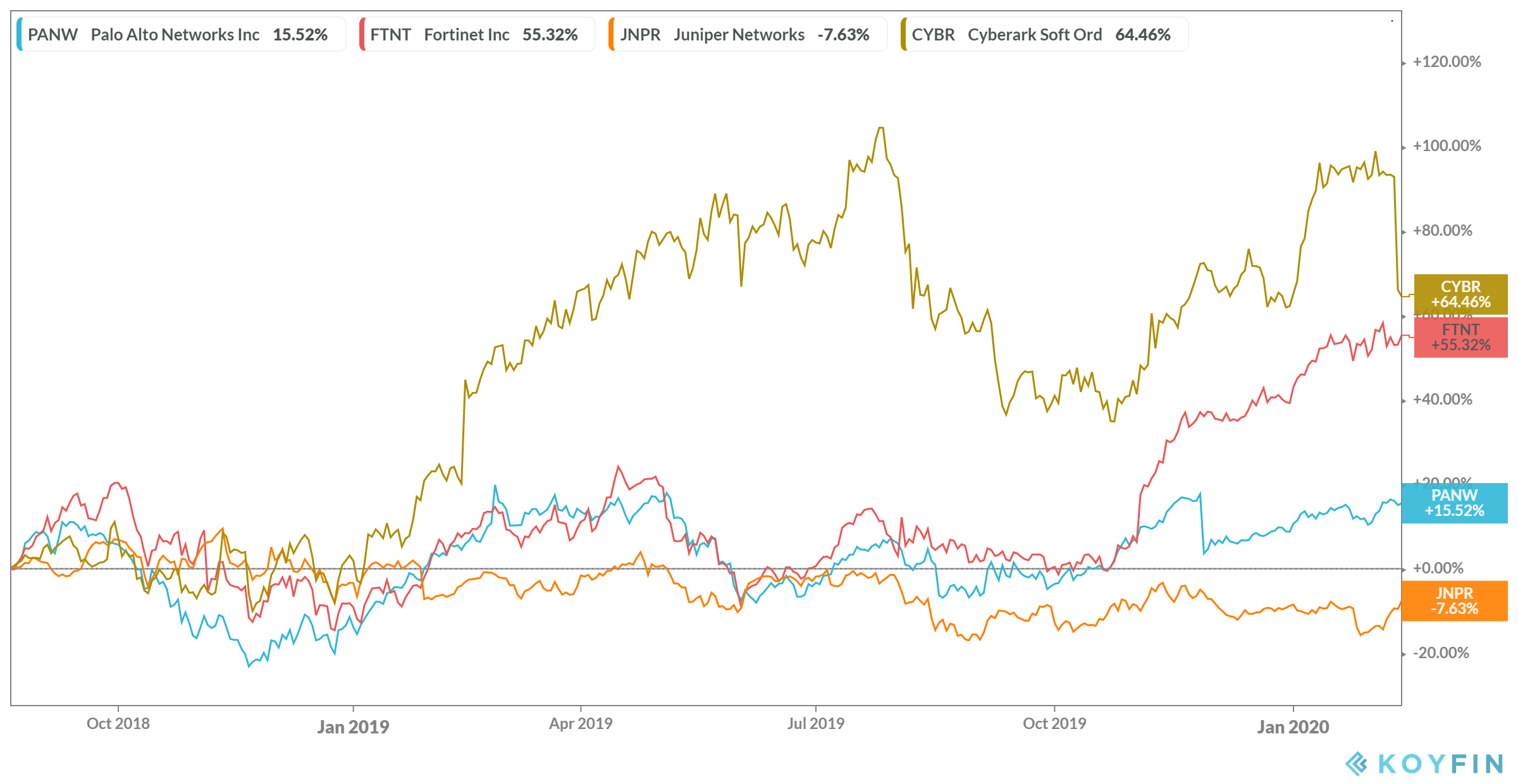

We have chosen four promising companies and implemented them for risk adjustment approach in a 18M Barrier Reverse Convertible. Since there will remain some volatility we equipped this product with a low european Barrier 55%. Due to the decreasing Autocall-Level, the probability for an early redemption is increased. The significant price declines from the last days make this product additionally attractive.

The guaranteed Coupon exceeds the average dividend yield from:

- Palo Alto Networks Inc (no dividend)

- CyberArk Software Ltd (no dividend)

- Juniper Networks Inc (3.43%)

- Fortinet Inc (no dividend)

significantly.

18M BRC on Cyber Security in CHF/EUR/USD

| Currency | CHF | EUR | USD |

| Denomination | CHF 1'000.-- | EUR 1'000 | USD 1'000 |

| Maturity | 18 months | ||

| Underlying (Worst Of) | Palo Alto Networks Inc (PANW:US) CyberArk Software Ltd (CYBR:US) Juniper Networks Inc (JNPR US) Fortinet Inc (FTNT US) |

||

| Coupon guaranteed | 12.32% p.a. | 11.84% p.a. | 14.20% p.a. |

| Barrier (european) | 59% | ||

| Observation | Quarterly | ||

| Autocall | Q1: No Autocall Q2: 100% Q3: 98% Q4: 96% Q5: 94% Q6: 92% |

||

| Indication | 25.02.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

The chart provides you the development of the relevant underlyings during the last 18 months: