Week 16: How to pay in times of Corona

How to pay in times of corona?

The current situation further enhanced the trend for cashless paying. Due to a fear to catch the disease from coins or notes, the payment systems in shops are almost unexceptionally electronical. Furthermore there is an ongoing rise in online payment. Even food is multiplied ordered over the internet and the payments are done online. There are more and more voices of experts and studies which imply that this could be the end of cash money. From official sources of the WHO possible infections from notes and coins were already adressed.The FED put dollar bills, which returns back from asia to the US, in quarantine for at least one week. In the meanwhile there are countless examples. The news agency bloomberg predicts the end of cash money in sweden at 2030. One of the goals of the succesfull Alibaba Group is to transform China into a cashless country. These developments will be significantly accelerated by Corona. Data protection authorities are already sending alarms, but this trend can hardly be stopped. Even in times after the crisis enhanced hygiene rules will be maintained to prevent subsequent infections. Electronical- and onlinepayments will increase in the medium and longterm. This rising sector is undoubtly an important part of the prospective Industry 4.0.

This week we present you three interesting companies which will, due to various unique selling points, continue to profit also in the future.

- The ambitious german supplyer of various digital payment solutions Wirecard shows since the refuted accounting fraud charges an enormous potential to reach the global supremacy in the area of the whole supply chains of innovative cashless payment opportunities for companies and humans.

- The unchallenged market leader in the online-payment sector for small and medium amounts is undoubtly Paypal. The most popular company in this area supplies the highest security standards and is usable in all conventional operating systems.

- Company No. 3 isn't as much innovative as the presented companies before but profits from a big unique selling point regarding cult and status. The legendary black centurion credit card from American Express is one of the most popular status symbols in the high society and for many people the embodiment of the "American Dream". There is no credit card company which understands it as well to integrate status and emotions in his image. The permission to start business in China is close where they are already doing a joint venture with LianLian in the 27 trillio USD market. There is no doubt that there is a predilection into the "Middle Kingdom" for luxury goods and status.

The Outperformance Certificate is aimed to investors which assume that there will be significant rising rates of the underlyings within the maturity. They would like to use this situation with a leveraged product. This certificate is further equipped with reduced participation (75%) in case of decreasing prices.

6M/12M/18M Outperformance Certificate on Payment in EUR

| Maturity | 6 months | 12 months | 18 months |

| Currency | EUR | ||

| Denomination | 1000 EUR | ||

| Underlying (Worst of) | American Express (AXP US) Paypal Holding (PYPL US) Wirecard AG (WDI GY) |

||

| Participation up | 299% | 315% | 330% |

| Participation down | 75% | 75% | 75% |

| Indication | 15.04.2020 | ||

| Size | EUR 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

Redemption (12M)

| Performance worst-of | Redemption |

| +50% | 257,5% |

| +20% | 163% |

| +-0 | 100% |

| -25% | 81,25% |

| -50% | 62,50% |

The Barrier Reverse Convertible is aimed to investors which would like to benefit from guaranteed coupons within the maturity. They are uncertain about the precise development of the underlyings. Therefore this risk adjusted structure is equipped with a low European Barrier with 59% or a leveraged Put Strike 75% .

The guaranteed Coupons exceed the expected average dividend yield of American Express (1.84%) Paypal (--) and Wirecard (0.17%) significantly.

6M/12M/18M Barrier Reverse Convertible on Payment in EUR

| Maturity | 6 months | 12 months | 18 months |

| Currency | EUR 1'000 | ||

| Denomination | EUR 1'000 | ||

| Underlying (Worst of) | American Express (AXP US) Paypal Holding (PYPL US) Wirecard AG (WDI GY) |

||

| Coupon guaranteed with European Barrier 59% |

20.12% p.a. | 18.52% p.a. | 15.60% p.a. |

| Coupon guaranteed with Put Strike 75% |

19.20% p.a. | 16.80& p.a. | 14.40% p.a. |

| Observation | Quarterly | ||

| Autocall | after 3 months 100%; each period decreasing -2% | ||

| Indication | 15.04.2020 | ||

| Size | 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon Request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

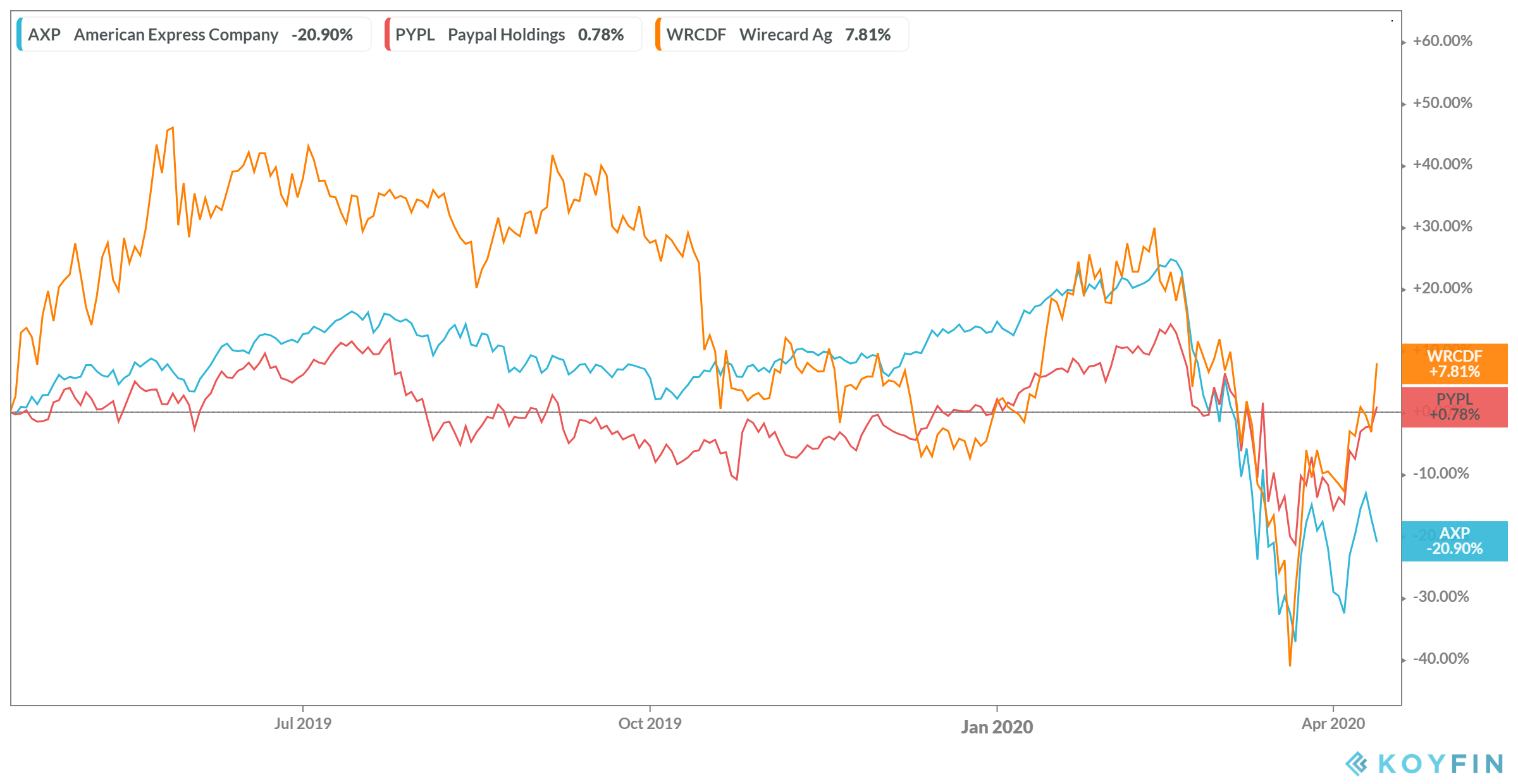

Please find below the chart with the development of the relevant underlyings during the last 18 months: