Woche 27: Hedging on the NASDAQ 100 with the Bearish Mini-Future

Bearish Mini-Future on NASDAQ 100

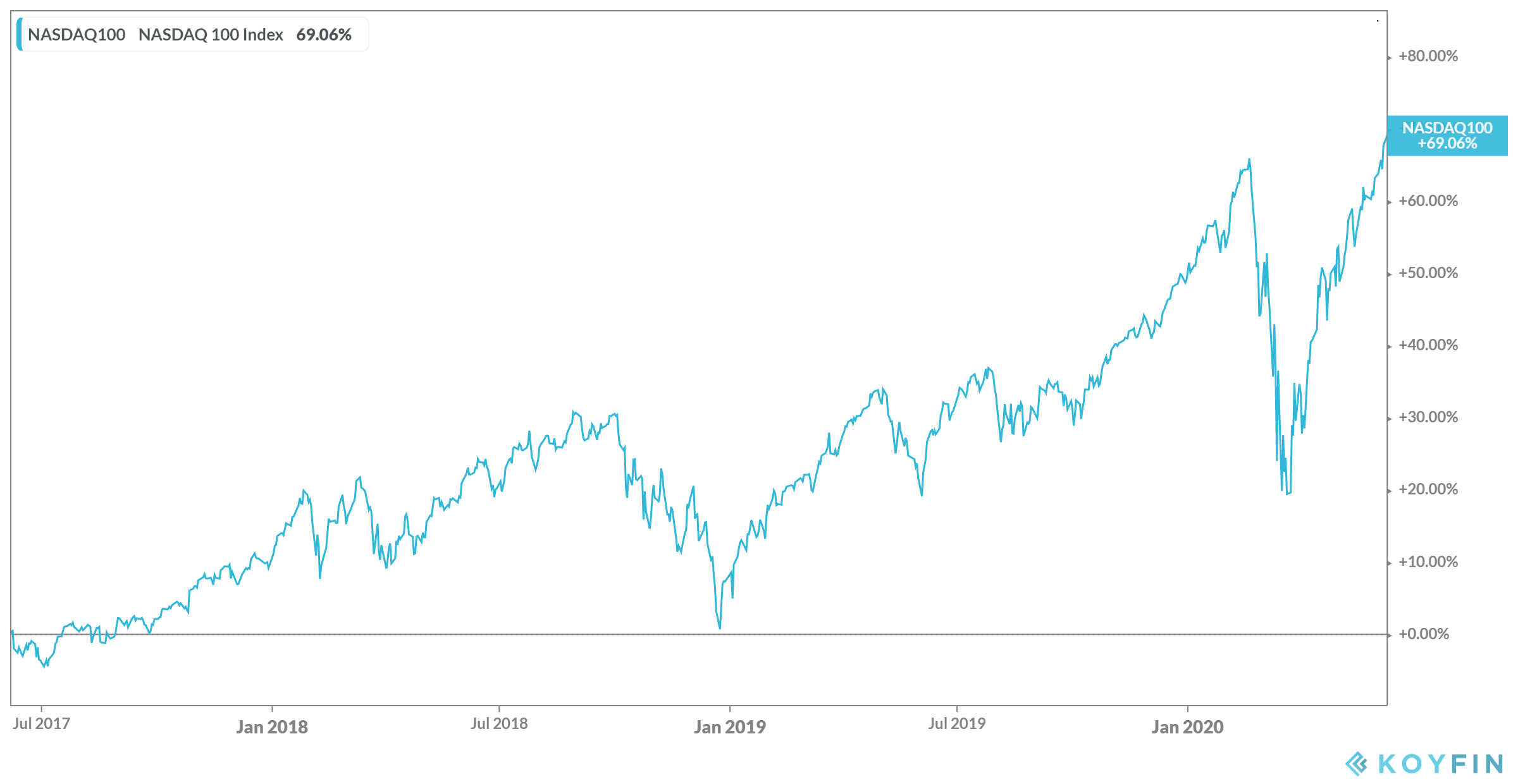

After the bottom line has been reached there is only one direction for most most of the indices. Upwards and steeply. The NASDAQ 100, which replicates the 100 most capitalized (non-financial) stocks of the the NASDAQ, is known as the most important index of the technology sector. Even the Alltime-High could be reached. Are the markets already to hot?

Our product of the week is aimed to investors, who would like to hedge against setbacks. The bearish Mini-Future on the NASDAQ 100 makes an proxy-hedging possible. Perfectly suited for investors who are already invested in various stocks of the US technology sector. Investors who expect a negative development of the NASDAQ 100 this product is perfectly suited for speculation activities.

The market for leveraged products have experienced a dynamic development during the last years. Mini Futures are actually pretty popular. Compared to traditional futures there is no obligation for fulfilment and no margin call. That's why these leveraged products can be used with less capital ressources.

Advantages of Mini Futures

- perfectly suited for hedging or speculation activities

- fair and transparant pricing

- no fulfilment obligation

- no margin calls

- low spread

- Delta = 1

| Maturity | 18.12.2020 | ||

| Currency | USD | ||

| Underlying | NQU0 Index (Sep29) E-mini Nasdaq 100 | ||

| Spot | 10100.00 | ||

| Strike | 12078.00 | ||

| Stop Loss* | 10770.00 | ||

| Leverage | 5 | ||

| Indication | 01.07.2020 | ||

| Size | USD 484'800;-- | ||

| Issuer | Tbd. | ||

| Issue Price | USD 20.200 | ||

| Finders Fee | Up on request | ||

*Stop Loss wird adjustiert

Redemption (NASDAQ 100):

| NASDAQ 100 (Indexstand) | 8000 | 9000 | 9500 | 10300 | 10770 (Stop Loss) |

| Performance Bear Mini Future | +103,96% | +54.46% | +19.70% | -9.90% | -33.17% |

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

Please find below the chart with the development of the relevant underlyings during the last 3 years: