Week 30: Barrier Reverse Convertible (One Star) on Insurance Companies in USD/EUR/CHF

Barrier Reverse Convertible (One Star) on Insurance Companies in USD/EUR/CHF

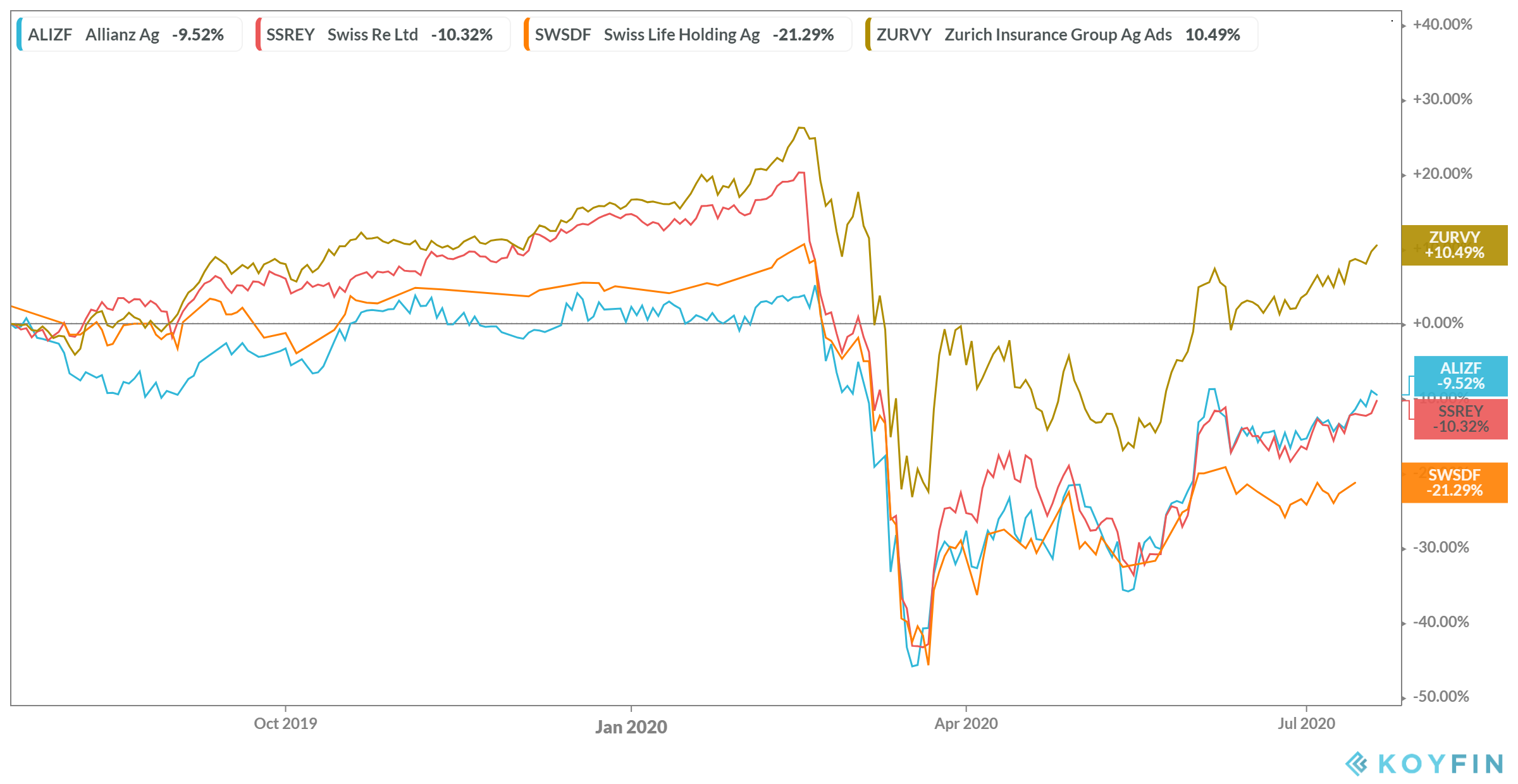

The insurance industry has almost recovered after corona. For whom a direct investment seems to risky should have a look on our product idea of the week.

This week we have developed a 12M Barrier Reverse Convertible with a guaranteed Coupon and the One Star Feature. This product is equipped with a european Barrier 69%. The special thing about this product is that the premium for the One Star Feature is extremely less (see table below).

One Star Feature

Even in case of a barrier event, if the best-of (at least one of the underlyings) ≥ 100% at maturity; redemption = 100%. So the One Star Feature provides a second chance.

The guaranteed coupons exceed the average dividend yields of

- Zurich Insurance Group AG (5.70%)

- Swiss Life Holding AG (4.15%)

- Swiss Re AG (7.74%)

- Allianz SE (5.05%)

significantly.

Market opinion:

- weakening prices possible but not below the barrier level

- sideways trend or slightly increasing

12M BRC on Insurance Companies in CHF/EUR/USD

| Maturity | 12 months | ||

| Currency | CHF | EUR | USD |

| Denomination | 1000 CHF | 1000 EUR | 1000 USD |

| Underlying (Worst of) | Zurich Insurance Group AG (ZURN SW) Swiss Life Holding AG (SLHN SW) Swiss Re AG (SREN SW) Allianz SE (ALV GR) |

||

| Coupon guaranteed with European Barrier 69% + One Star |

9.50% p.a. | 9.65% p.a. | 10.40% p.a. |

| Coupon guaranteed with European Barrier 69% |

9.60% p.a. | 9.98% p.a. | 10.60% p.a. |

| Observation | Quarterly | ||

| Autocall | 100% | ||

| Indication | 22.07.2020 | ||

| Size | CHF 1'000'000;-- | EUR 1'000'000;-- | USD 1'000'000;-- |

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers.

Text and analysis by Florian Franz

Partner at Carat Solutions AG

Please find below the chart with the development of the relevant underlyings during the last 12 months: