Week 38: Hot spot oil: Outperformance Certificate

Hot spot oil

How you can benefit from increasing oil prices with the Outperformance Certificate

The growing conflicts between Iran and the US, especially the attacks on the refineries in Saudi Arabia, draw the attentions on the oil issue.

- The brent crude oil increased by more than 13%; the biggest intraday jump since 1988

- The attacks crippled 5% of the world wide oil pruduction at one go

- Refineries will remain an easy target for terroristic attacks

- Further potential attacks in the middle east as price drivers

- Oil is found in a wide variety of products (e.g. plastic, clothes, etc.)

- There are alternatives for cars and heatings; but not for plastic.....

Having already presented you similar topics with the Twin Win Certificate in the past we will introduce you now in the opportunity to realize your market view into profit with the Outperformance Certificate. You will gain from increasing oil prices with a upside participation factor of 1.91. Simultaneously a potential decrease in prices will be cushioned by a downside participation factor of 0.75.

12M Outperformance Certificate on Brent Crude Oil

| Currency | USD | |

| Denomination | USD 1000 | |

| Maturity | 1 year | |

| Underlying | Brent Crude Oil(CO1:COM) | |

| Participation up | 191% | |

| Participation down | 75% | |

| Issuer | tbc | |

| Issue Price | 100% | |

| Finders fee | Up on request | |

Redemptions

| Performance of the underlying at maturity | Redemption Outperformance Certificate |

| +50% | 195.50% |

| +20% | 138.20% |

| +-0 | 100% |

| -25% | 81.25% |

| -50% | 62.50% |

We are happy to customize the relevant components exactly to your personal preferences.

Are you interested in profitable companies from this area? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis Florian Franz

Partner at Carat Solutions AG

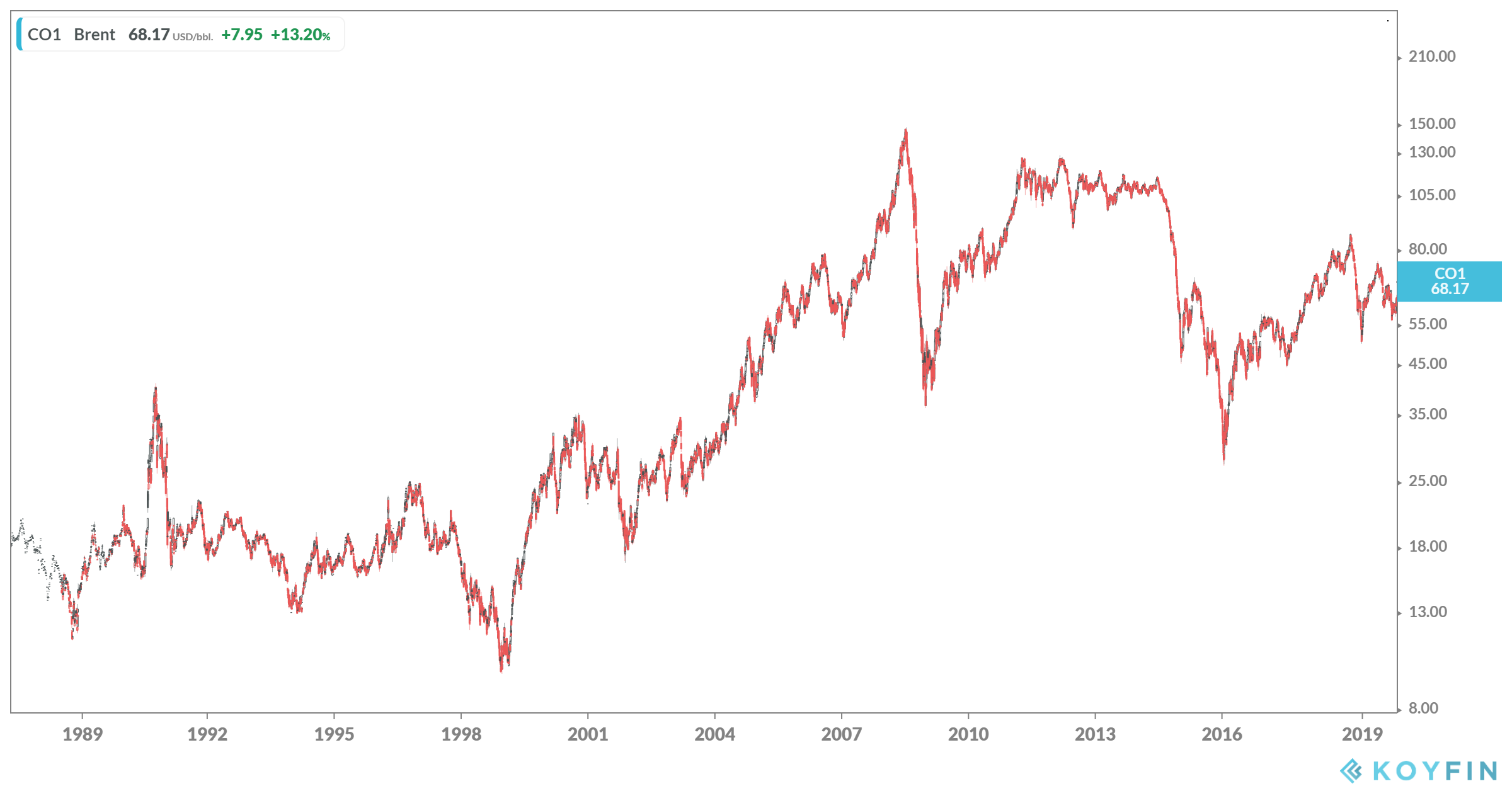

The long-time-chart provides you the development of the oil prices since 1987: