Week 8: Automotive Suppliers, Trade Barriers and Corona

Risk adjusted investments within the Automotive Supplier Industry under the aspect of Trade Barriers and Corona

The automotive industry doesn't have it easy actually. The sales market in China already lost ground last year and has now also to deal with the consequences of the Corona Virus. As known when the main customers cough the automotive suppliers feel it in amplified form. Since the automotive companies suffer to a special degree from the current situation with trade barriers and the possible virus spread, the suppliers are affected by a multiplier. The giant of the sector VW engages about 100'000 employees in the Middle Kingdom (China) in certain joint ventures and sells about 40% of their vehicles in China. Temporary production losses and forbidden official journeys will have an adverse effect on the first quartals in 2020. The first plants are opening again but the increased security procedures will raise the prospective costs.

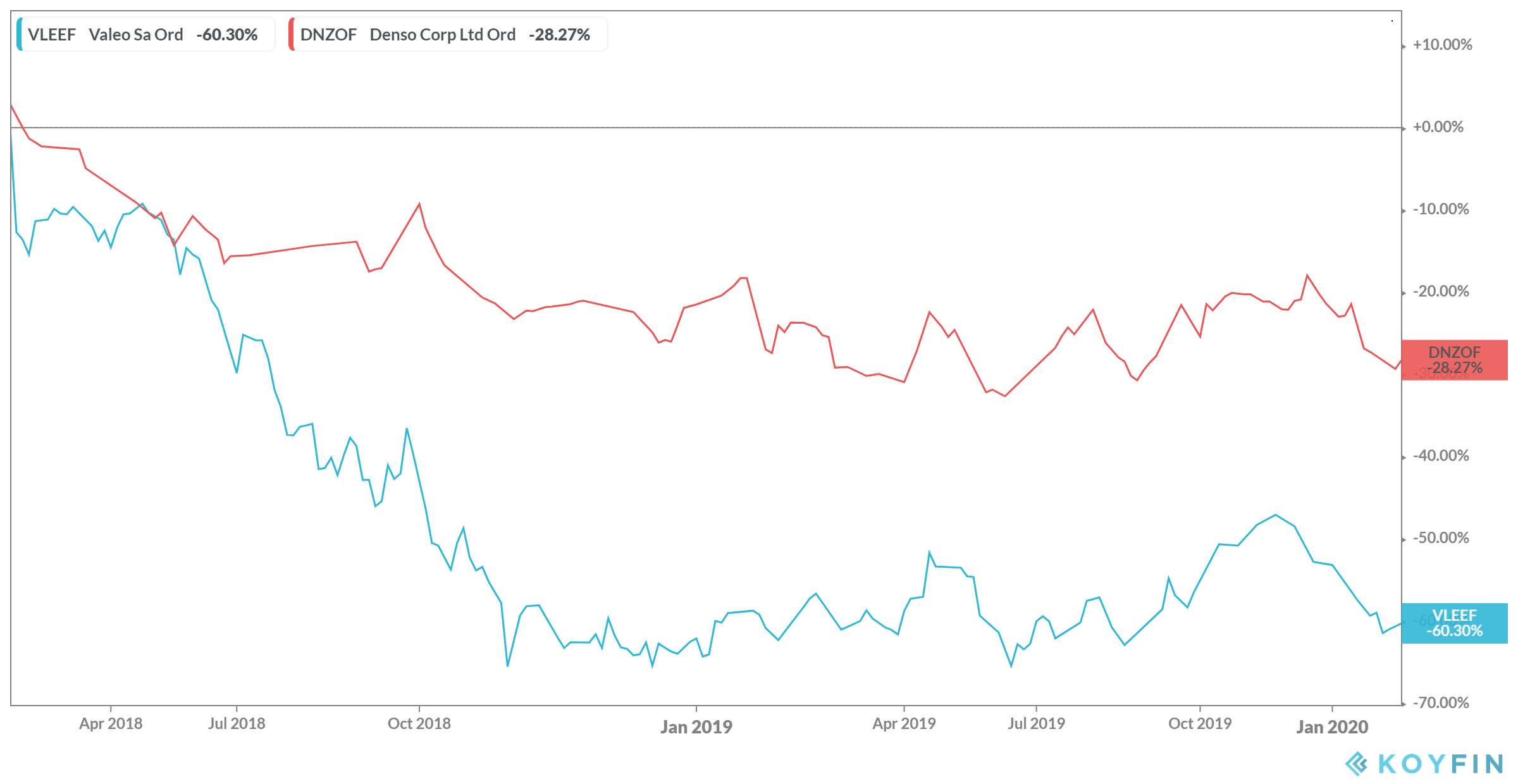

To profit from these circumstances in an effective way we decided to choose three interesting companies, which show in the medium term price chart a comprehensible downside potential and whose courses has been fallen tendencially in the last weeks.

Continental AG: Especially famous as a tyre manufacturer, in the meanwhile also one of the biggest automotive supplier worldwide. Around 26'000 employees are engeged in China.

Denso Corp: After Continental No. 3 worldwide. The proximity to China and a share of 30% of sales from the japaneese producer Honda in China underlines the strong presence of this company.

Valeo SA: The innovative supplier from France is, inter alia, participating in various Start-Up-Companies in China . The company is mainly marked in the future oriented electronic mobiliy area

Market opinion:

- to be sure to save a soft landing also in the Worst-Case-Scenario (see also below Redemption Leverage Put Strike)

- constant or moderate decreasing / less than 25% (Leverage Put Strikes)

- constant or moderate decreasing / less than 37% (EU-Barrier)

We developed with the above mentioned companies a riskadjusted investment opportunity in the structure of an Express Certificate with a maturity of 12 month, a guaranteed Coupon as well as a Leveraged Put Strike 75% (optionaly also with EU-Barriere 63%).

12M Express Certificate auf Automotive Supplier in CHF/EUR/USD

| Currency | CHF | EUR | USD |

| Denomination | CHF 1'000.-- | EUR 1'000 | USD 1'000 |

| Maturity | 12 months | ||

| Underlying (Worst Of) | CONTINENTAL AG (CON GY) DENSO CORP (6902 JT) Valeo SA (FR FP) |

||

| Coupon guaranteed with Leveraged Put Strike 75% |

6.00% p.a. | 6.30% p.a. | 8.30% p.a. |

| Coupon guaranteed with EU Barrier 63% |

6.00% p.a. | 6.30% p.a. | 8.30% p.a. |

| Observation | At maturity | ||

| Indication | 20.02.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Up on request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Redemptions* Leveraged Put Strike + European Barrier

| Performance of the worst-of underlying at maturity | Redemption at maturity with 75% Lev. Put Strike** | Redemption at maturity with 63% European Barrier |

| +25% | 100% | 100% |

| -20% | 100% | 100% |

| -30% | 93.33% | 100% |

| -40% | 80.00% | 60% |

| -50% | 66.66% | 50% |

| -60% | 53.33% | 40% |

| -70% | 40.000 | 30% |

| -80% | 26.66% | 20% |

| -100% | 0% | 0% |

*the guaranteed Coupon will be paid independently from the performance of the underlyings

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

The chart provides you the development of the relevant underlyings during the last 24 months (Continental will follow):