Capital Protection

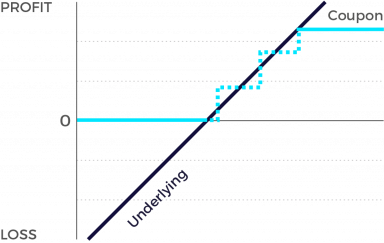

Capital Protection Certificate with Coupon

Capital-protected products without a cap offer a guaranteed repayment of principle (upon maturity) as well as the opportunity to participate in price gains of the underlying instrument. However, owing to the guarantee, the participation rate is normally lower than what you’d realize by owning the underlying security outright. There are exceptions in this regard, for example in the case of index-based products for which the issuer can finance all or a part of the guarantee by means of the dividends received.

Market expectation

- Rising underlying

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- The coupon payment amount is dependent on the performance of the underlying

- Periodic coupon payment is expected

- Limited profit opportunity

Graphic

Capital-protected products that feature a knock-out are offered in two slightly different versions. As a general rule, investors in these certificates participate 1:1 in any price increases up to the knock-out level. If that threshold is exceeded, the option dimension expires worthless and the investors no longer participate in further price gains. But with one form of these certificates, the investors are credited with a rebate as soon as the knock-out takes place. They no longer participate in the gains, but they at least receive an additional fixed payment at the end of the certificate’s term.