Participation Products

Tracker Certificate

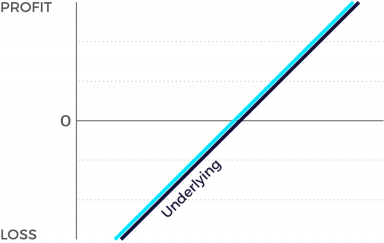

If the underlying increases, usually the price of the corresponding participation products increases as well. If the underlying falls, usually the price of the corresponding participation products falls as well. Often the participation products have no limited lifespan which is indicated by the suffix "Open End". In addition, the issuer risk must be taken into consideration with all participation products, since the capital invested could be lost if issuer becomes insolvent – irrespective of the performance of the underlying asset.

Market expectation

- Rising underlying

- Declining underlying (Bear Tracker)

Characteristics

- Participation in development of the underlying

- Reflects underlying price moves 1:1 (adjusted by conversion ratio and any related fees)

- Risk comparable to a direct investment into the underlying

Graphic

Due to the captivatingly simple way they work, tracker certificates have for years been one of the most popular structured products. They trade in lockstep with the price movements of a given index. Most of these products are tied to recognized stock market barometers such as the SMI or DAX. Thus with a single investment in a tracker certificate, you can diversify your risk exposure across a wide range of individual stocks.

With tracker certificates, you have a simple and cost-effective means of investing in an entire stock market without having to buy each of the individual shares. Moreover, tracker certificates facilitate your access to exotic markets where, as a general rule, you would not even be able to trade via your bank or broker.Major international share indices are often priced in thousands of points. But so you don’t have to pays thousands of francs just to buy a single certificate, most trackers are based on an exchange ratio. By way of example, a tracker with an exchange ratio of 0.1 represents in monetary terms one-tenth of an index, which in turn makes it possible to invest in a tracker certificate with smaller amounts of money.

If you wish to invest in certificates based on foreign indices, you should keep in mind that those indices are frequently priced in some other currency than the Swiss franc. Thus if the tracker certificate is not currency-hedged (a so-called quanto certificate), you also assume a foreign exchange risk because the present value of the given currency in relationship to CHF is subject fluctuations.

You should also determine whether the tracker certificate is based on a price index or a performance index. There’s an important difference here: with a performance index, all dividends and proceeds from subscription rights are reflected in the level of the index; price indices, on the other hand, reflect solely the price developments of the constituent shares and thus also the reductions in value that take place whenever a dividend is paid.

Essentially, tracker certificates are the product of choice if you expect the market to go up, don’t wish to spend time focusing on specific shares, and desire to spread the your investment risk across a large number of individual stocks. Roughly two-thirds of all tracker certificates have no fixed term and instead are offered as open-ended instruments.

Bear tracker certificates are a special form of structured product because they represent the exact opposite of a normal tracker certificate; in other words, they gain in value when the price of the underlying instrument declines (and of course vice versa). Thus bear tracker certificates are suitable for investors who anticipate falling prices and therefore want to «go short».