Previous

Next

Leverage products

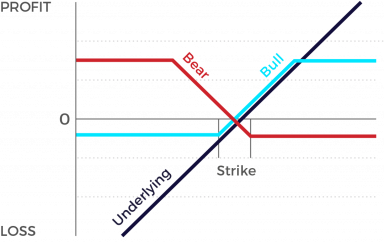

Spread Warrant

Leveraged products are financial instruments that enable traders to gain greater exposure to the market without increasing their capital investment. They do so by using leverage.

Any financial instrument that allows you to take a position that is worth more on the market than your initial outlay is a leveraged product. Different leveraged products work in different ways, but all amplify the potential profit and loss for a trader.

Leveraged products will almost always require you to pay an initial portion of the position you intend to open. This is called the margin.

Market expectation

- Spread Warrant (Bull): Rising underlying

- Spread Warrant (Bear): Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Daily loss of time value (increases as product expiry approaches)

- Continuous monitoring required

- Limited profit opportunity (cap)

Graphic