Yield Enhancement

Discount Certificate

Many Investment Products aimed at optimizing yields offer partial protection. This can provide attractive returns even when the price of the respective underlying asset just remains stationary up to maturity. Since the capital protection is often conditional (e.g. in the form of a barrier) or is only partially provided (e.g. in the form of a price reduction), loss of invested capital may nonetheless occur on maturity. In addition, the opportunity for yield that is expected is often limited to a maximum return.

Market expectation

- Underlying moving sideways or slightly rising

- Falling volatility

Characteristics

- Should the underlying close below the strike on expiry, the underlying and/or a cash amount is redeemed

- Discount Certificates enable investors to acquire the underlying at a lower price

- Corresponds to a buy-write-strategy

- Reduced risk compared to a direct investment into the underlying

- With higher risk levels multiple underlyings (“Worst-of”) allow for higher discounts

- Limited profit opportunity (cap)

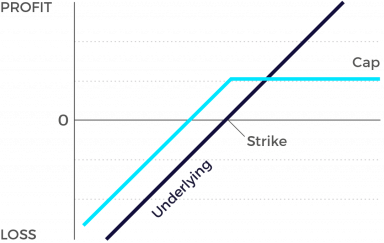

Graphic

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap). The lower the cap, the greater the discount.

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands. If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying stock is below the cap on the maturity date, the corresponding number of shares is usually delivered into your account. For discount certificates based on indices, baskets, currencies or fixed income securities, you’ll receive instead a cash settlement reflecting the value of the underlying instrument as it stood on the maturity date. However, in certain instances, cash settlement can also be arranged for discount certificates on shares.

If you hold your discount certificate through to maturity, you’ll only incur a loss if the price of the underlying instrument has fallen so far that the discount has been totally eroded. In essence, the discount works like a cushion against price declines in the underlying instrument. If you in fact incur a loss with a discount certificate, it will in any case be less than the amount you would have lost by investing directly in the underlying instrument.

Discount certificates work particularly well in sideways markets. If you expect that to be the case, it’s best to choose a product with a cap that’s relatively close to the current price of the underlying instrument. Products with a cap somewhat above the current price are suitable if you anticipate modestly rising markets.

Extremely defensive discount certificates with a cap far below the current market price of the underlying instrument (deep-discount certificates) are also used by some investors as a substitute for time deposits. With this approach, you can achieve annual returns of three to five per cent while enjoying a relatively comfortable safety buffer.

The classical version of a discount certificate as described above has evolved in recent years with issuers creating an array of interesting byproducts. One of them is the «rolling discount certificate». This product type is no longer constrained by a predetermined maturity date…it just keeps on rolling. Your capital is continually reinvested at regular intervals – in most cases either once a month or once a quarter – in new synthetic discount certificates.

Because normal discount certificates often tend to gain the greatest amount of value in the final weeks of their term, you as an investor gain optimum benefit with these short-running, artificial discounts from sideways moves in the market, and this without your having to constantly swap in and out of certificates. There’s a catch of course: in a heartbeat, a short, sharp downside move in the market can eradicate all of the many small gains you’ve booked over time with your rolling discount certificate.