Week 14: Outperformance Certificates and BRC's on undervalued mineral oil groups

The oil price in free fall. How to profit from the forthcoming turning point of the oil price development

At the moment we are experiencing the unique situation of falling oil prices and increasing supply. While the drop in oil prices is due to economic fears triggered by corona the increasing demand is the result from the price dispute between Saudi Arabia and Russia. This situation has also a negative impact to the stock prices of the oil companies. The enterprises react with cost cuts and increased efficiency. Like in every crisis we will see consolidation activities. The best competitors will come out stronger from this crisis and will also rise their market power after corona. This week we found out five leading companies of the mineral oil industry which have the best market positions. To satisfy diverse preferences we present you two different products.

The Outperformance Certificate is aimed to investors which assume that there will be significant rising rates of the underlyings within the maturity. They would like to use this situation with a leveraged product. This certificate is further equipped with reduced participation (75%) in case of decreasing prices.

12M/24M/36M Outperformance Certificate on Oil-Companies in USD

| Maturity | 12 months | 24 months | 36 months |

| Currency | USD | ||

| Denomination | 1000 USD | ||

| Underlying (Worst Of) | Royal Dutch Shell (RDSA NA) Exxon Mobil Corp (XOM US) Chevron Corp (CVX US) Total SA (FP FP) BP PLC (BP/ LN) |

||

| Participation up | 341% | 420% | 455% |

| Participation down | 70% | 70% | 70% |

| Indication | 01.04.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

Redemption (12M)

| Performance worst-of | Redemption |

| +50% | 270.5% |

| +20% | 168.2% |

| +-0 | 100% |

| -25% | 82.50% |

| -50% | 65% |

The Barrier Reverse Convertible is aimed to investors which would like to benefit from guaranteed coupons within the maturity. They are uncertain about the precise development of the underlyings. Therefore this risk adjusted structure is equipped with a low european barrier with 59%.

12M/24M/36M Barrier Reverse Convertible on Oil-Companies in USD

| Maturity | 12 months | 24 months | 36 months |

| Currency | USD | ||

| Denomination | 1000 USD | ||

| Underlying (Worst Of) | Royal Dutch Shell (RDSA NA) Exxon Mobil Corp (XOM US) Chevron Corp (CVX US) Total SA (FP FP) BP PLC (BP/ LN) |

||

| Coupon guaranteed with Put Strike 75% |

17.36% p.a. | 14.16% p.a. | 11.60% p.a. |

| Coupon guaranteed with Barrier (european) 59% |

19.60% p.a. | 14.92% p.a. | 13.52% p.a. |

| Observation | Quarterly | ||

| Autocall | after 3 months 100% each quarter decreasing -1% | ||

| Indication | 01.04.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

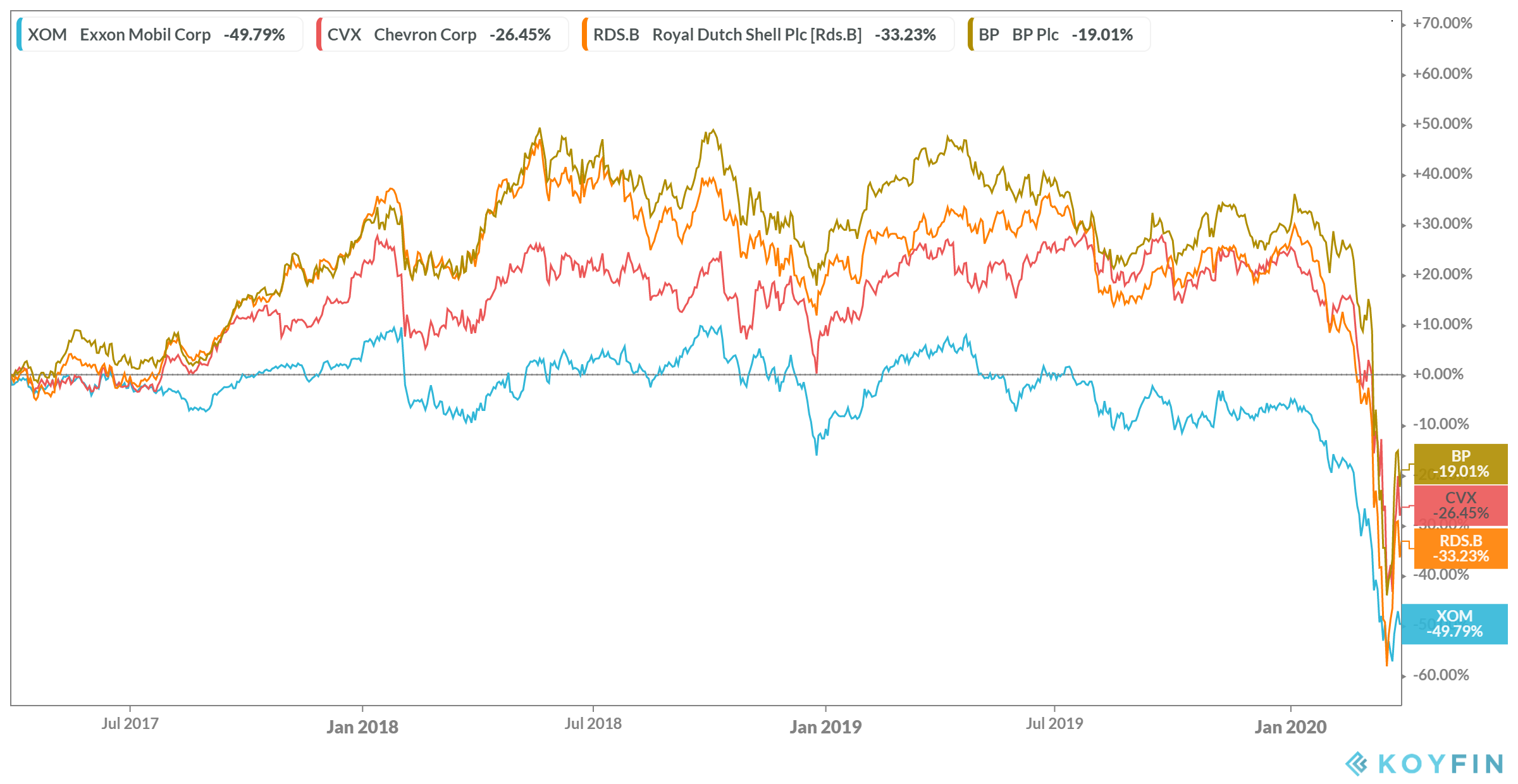

Please find below the chart with the development of the relevant underlyings during the last 36 months: