Week 19: Capital Protection Oil

Capital Protection on Oil

This week we present you a Capital Protected Note consisting of a equal weighted basket of the biggest and most succesfull oil and gas companies. This approach allows us to replicate the major part of the relevant ETF's and Funds in this area. Since the issuers are actually limited in providing relevant Oil-ETF's and Oil-Funds this strategy gives you the greatest possible flexibility. The idea behind is also, as already described in our idea of the week 14, that some small companies won't survive this crisis. Merger and Aquisitions will occur. The strong players will take over the weak ones.

In order to meet different market opinions we developed this product in two versions:

- Version Nr.1 in the structure of an 48M Capital Protected Note including 95% Capital Protection, 100% Participation and a Cap of 140%.

- Version Nr.1 in the structure of an 48M Capital Protected Note including 90% Capital Protection, 100% Participation and a Cap of 190%.

90%/95% Capital Protected Note on Oil Basket in USD

| Currency | USD (Quanto) | ||||

| Denomination | USD 1000 | ||||

| Underlying | Royal Dutch Shell (RDSA NA) Exxon Mobil Corp (XOM US) Petrochina (857 HK) Total SA (FP FP) BP PLC (BP/ LN) |

||||

| Maturity | 48 months | ||||

| Participation | 100% | ||||

| Cap with Capital Protection 95% | 140% | ||||

| Cap with Capital Protection 90% | 190% | ||||

| Strike | 100% | ||||

| Issuer | Rating A- minimum | ||||

| Issue Price | 100% | ||||

| Indication | 08.05.2020 | ||||

| Finders fee | Upon request | ||||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Redemption (Capital Protected Note 90%):

| Basket | 200% | 150% | 120% | 90% | 50% |

| Redemption | 190% | 140% | 110% | 90% | 90% |

Other interesting companies in this area:

- Petroleo Brasileiro SA (PBR US)

- Chevron Corp (CVX US)

- Lukoil PJSC (LKOD LI)

- Sinopec Group (386 HK)

- OMV AG (OMV AV)

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

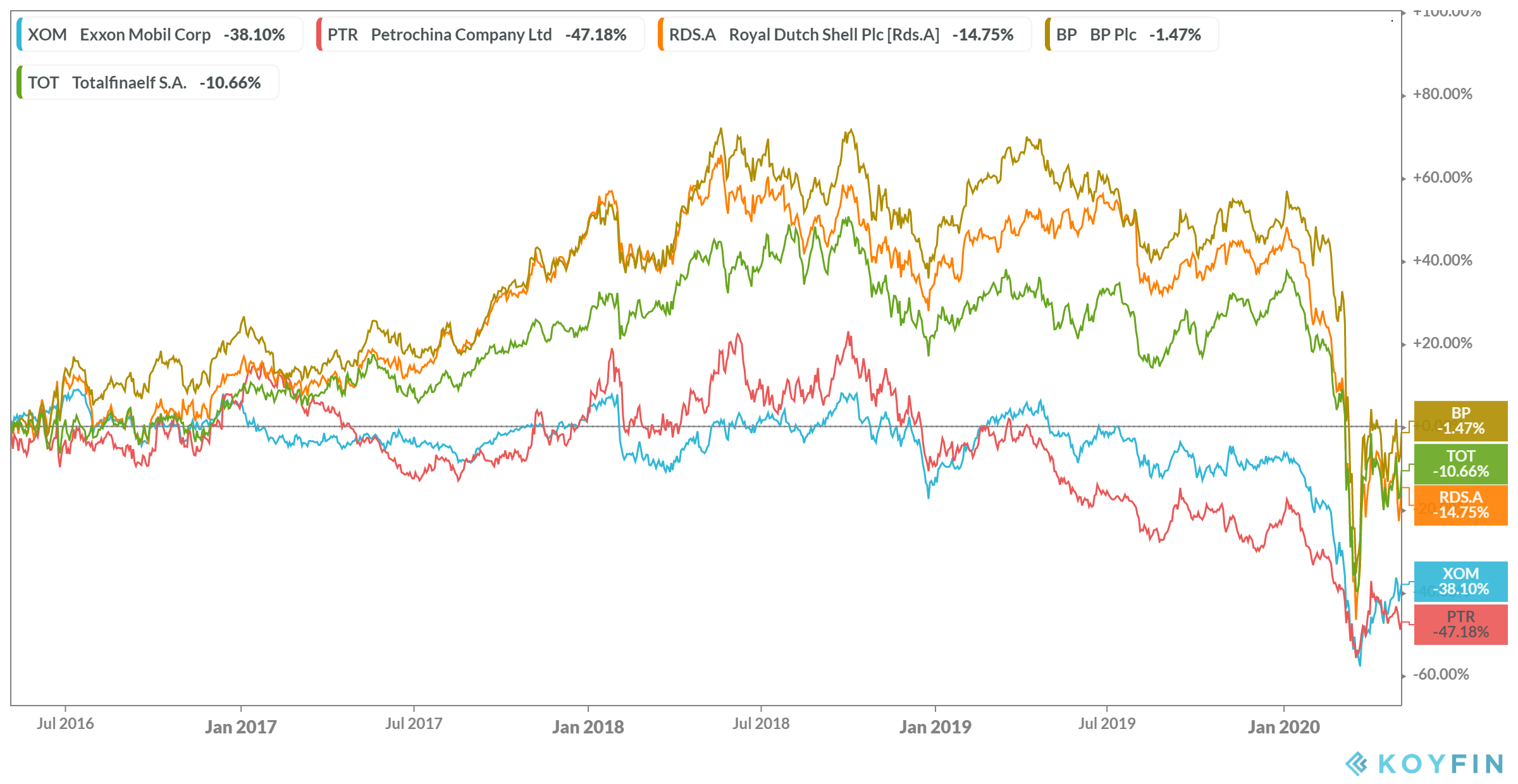

Please find below the chart with the development of the relevant underlyings during the last 48 months: