Week 24: One Star Feature / BRC on banks

Rising banks? BRC with One Star Feature on Banks

Rising banks?

It hasn't been easy for most banks the last years. Low interest rates and ambitious Online-Payment-Companies has strained the entire value chain. Since the bottom has been reached in the Corona period it seems to go uphill. Maybe the past course corrections of the financial institutes has been too excessive?

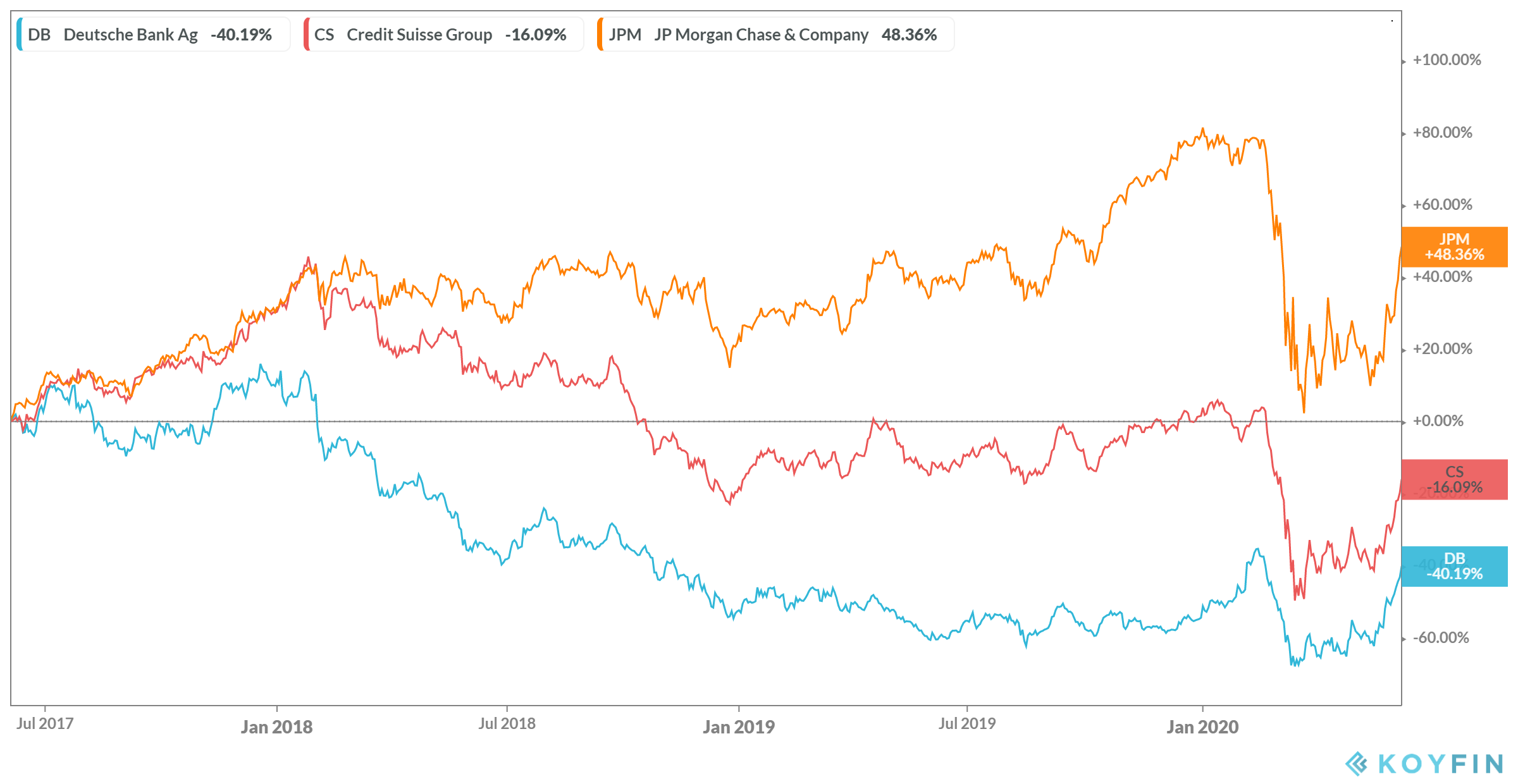

This week we developed a 12M Barrier Reverse Convertible with the popular One Star Feature on banks. Due to the different developments of Credit Suisse, JP Morgan and Deutsche Bank (see Chart below) this specification makes especially sense. The low european barriers provide a conditional capital protection.

One Star Feature

Even in case of a barrier event, if the best-of (at least one of the underlyings) ≥ 100% at maturity; redemption = 100%. So the One Star Feature provides a second chance.

12M BRC One Star on Banks in CHF

| Maturity | 12 months | ||

| Currency | CHF | ||

| Denomination | 1000 CHF | ||

| Underlying (Worst of) | Credit Suisse Group (CSGN SW) JP Morgan Chase Co (JPM US) Deutsche Bank AG (DBK GR) |

||

| Coupon guaranteed with European Barrier 59% |

12.20% p.a. | ||

| Coupon guaranteed with European Barrier 69% |

14.12% p.a. | ||

| Observation | Quarterly | ||

| Autocall | after 6 months 100% each quarter decreasing -5% | ||

| Indication | 11.06.2020 | ||

| Size | CHF 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Up on request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. We would be delighted to develop further hedging - arbitrage - or speculation opportunities for you. If you have already exact ideas of your favourite product we'll generate you the best conditions from more than 25 issuers.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

Please find below the chart with the development of the relevant underlying during the last 3 years: