Week 36: 18M Express Certificate with Memory Coupon and Put Strike on Indices in USD Quanto

Put Strike vs. Barriere

Our investment idea from week 36 presents an intersting alternative to a product with barrier on indices:

The Express Certificate with Put Strike und Memory Coupon

INDICES:

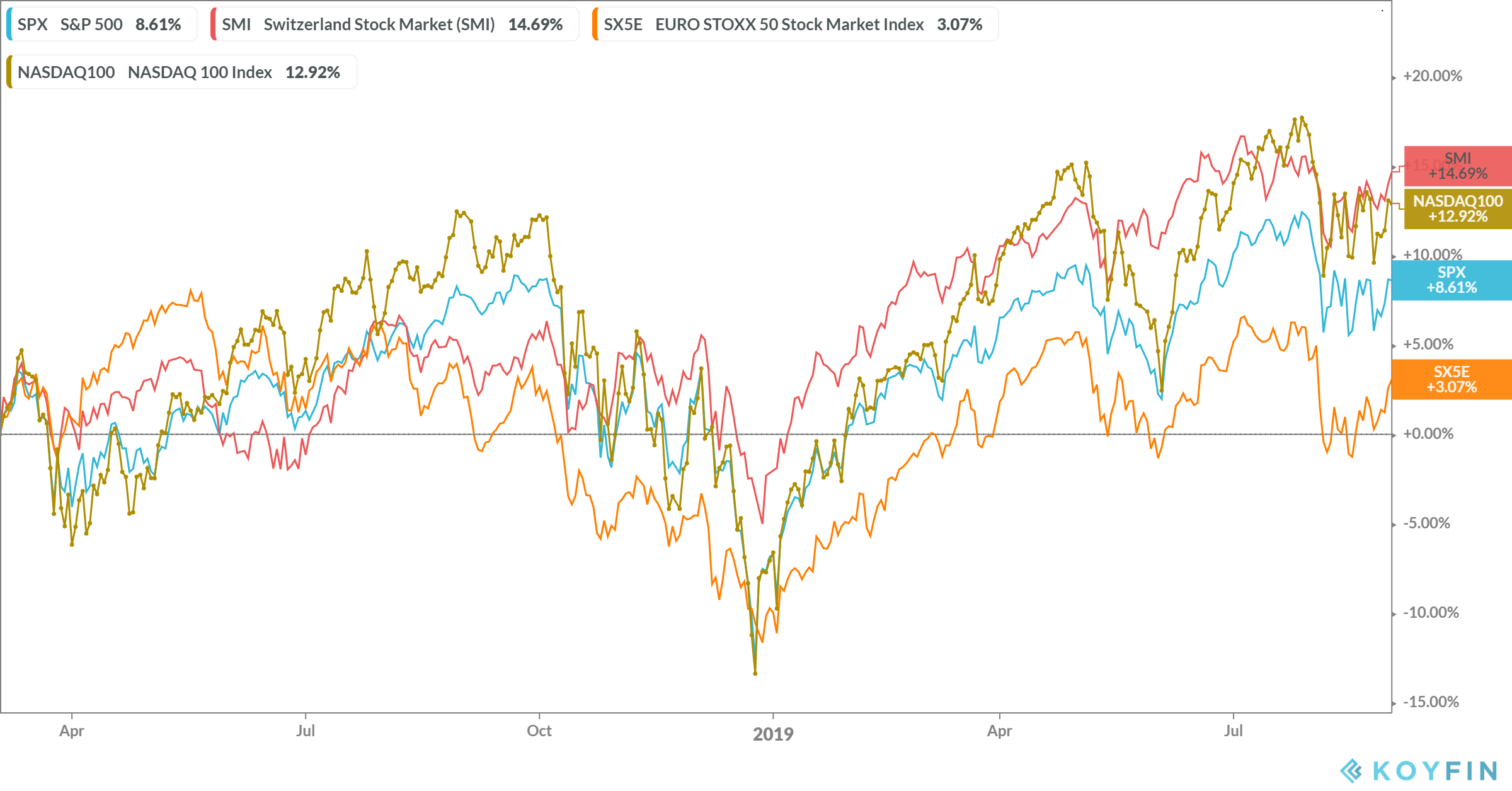

- S&P 500: The most important american indices. Includes the 500 biggest companies in the US

- NASDAQ 100: The highest capitalized 100 tech companies from the NASDAQ Composite Indices

- Euro Stoxx 50: The 50 biggest companies in the eurozone

- SMI: Represents the 20 most important companies from Switzerland

Since we assume that the volatility will remain we recommend you these indices in the structure of an Express Certificate with Memory Coupon and Put Strike. The maturity is 18 months, the Put Strike is at 78% an the Memory Coupon is 5.00% p.a (USD). The low Autocall 89% - first observation after 6 months - results in a high opportunity of an early redemption.

18M Express Zertifikat with Memory Coupon and Put Strike on Indices in USD Quanto

| Currency | USD Quanto |

| Denomination | USD 1'000.-- |

| Maturity | 18 months (early redemption possible) |

| Underlying (Worst-of) | EURO STOXX 50 (SX5E) NASDAQ (NDX) S&P 500 (SPX) SMI 100 (SMI) |

| Memory Coupon* | 5.00% p.a. (1.25%p.q.) |

| Coupon Barrier | 75% |

| Autocall | 89% |

| Observation | after 6 months |

| Lev. Put Strike | 78%* |

| Size | USD 1'000.'000.-- |

| Issuer | Rating A minimum |

| Issue Price | 100% |

| Finders Fee | Up on request |

We are happy to adapt the components to your personal preferences.

Put Strike vs European Barrier. A hidden put strike at maturity results, unlike the barrier, in much less damage. The Investor will loose the conditional capital protection only at the level of the Put Strike and not retroactive. In case of a hidden european barrier the investor will loose the conditional capital protection ex post.

Redemptions Put Strike vs. European Barrier

| Performance of the underlying at maturity | Redemption at maturity with 78% Lev. Put Strike** | Redemption at maturity with 78% European Barrier |

| +25% | 100% | 100% |

| -20% | 100% | 100% |

| -25% | 96.15% | 75% |

| -30% | 89,74% | 70% |

| -40% | 76.92% | 60% |

| -50% | 64,10% | 50% |

| -60% | 51,13% | 40% |

| -70% | 38,46% | 30% |

| -80% | 25,64% | 20% |

| -100% | 0% | 0% |

** Imagine, in case of an underlying performance of (-100%), the performances of both versions will converge to (-100%).

For this reason a Express Certificate with Put Strike results usually in a leverage effect. This one is calculated as follows: [Strike] / [Put Strike Level] = Leverage of Put Strike

Text and Analysis by Florian Franz

Partner at Carat Solutions AG

In the graph below you'll find the performance of the 4 relevant indices during the past 18 months: