Week 5: Risk adjusted investments in palladium

Palladium in risk adjusted structures of Capital Protection Notes and Barrier Reverse Convertibles

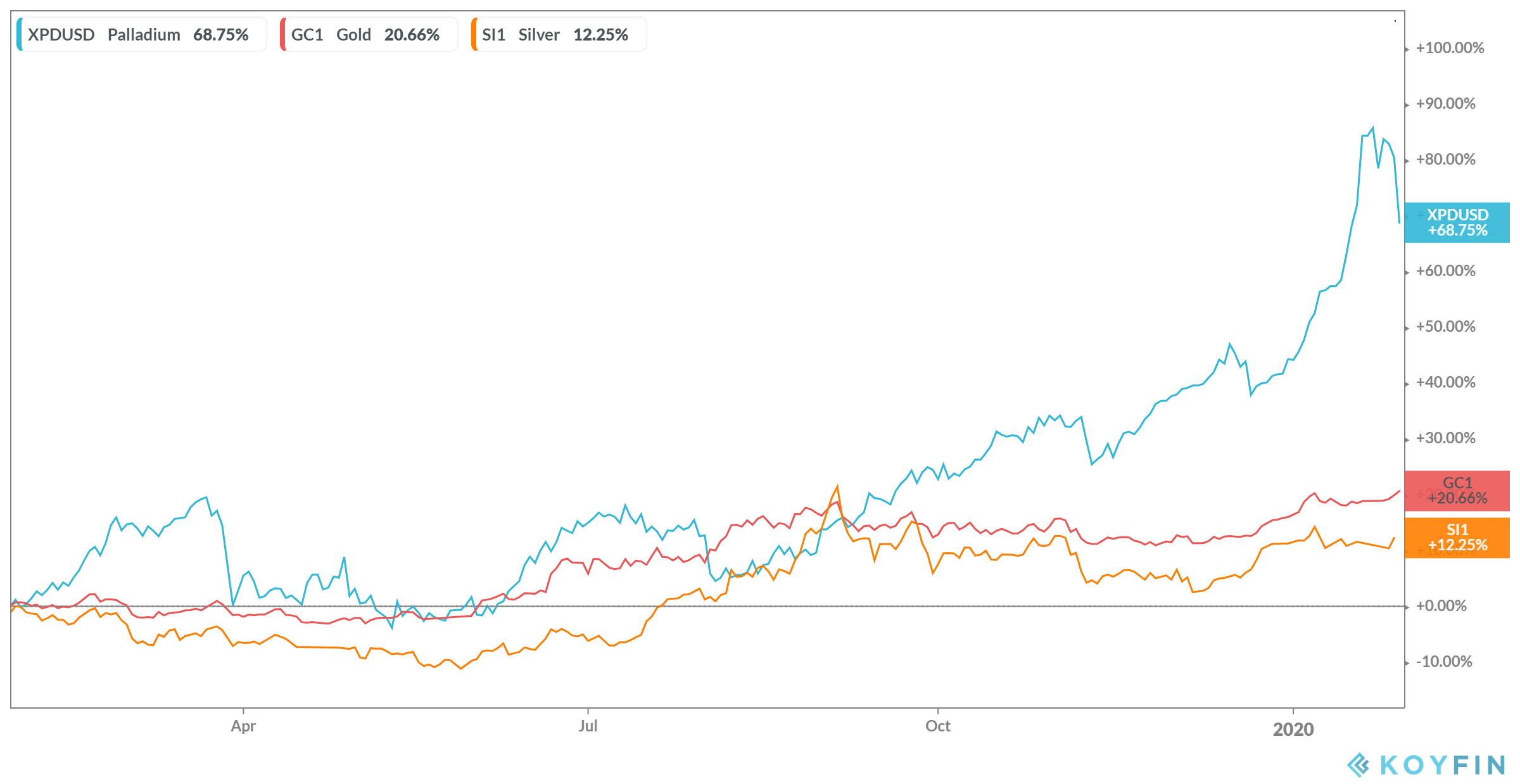

The precious metal Palladium is actually extremely fashionable. Already last year the commodity price almost doubled. In the first 25 days this january the course increased from 1700 Euro to more than 2100 Euro. What are the reasons behind this development?

- strong demand from the automotive industry. Tougher environmental standards meanwhile also in countries like China and India have grown the need rapidly. Modern three-way catalysts require these raw material. There is also a usage for fuel cells, electronics, der jewellery industry as well as the dental medicine

- the diesel emission scandal and the resulting increase of petrol engines supported the booming demand as well, since palladium is especially used in catalysts of gasoline cars

- supply shortages due to technical problems in mines of the exploiting countries e.g. South Africa

- more and more investors benefit from the price trend and therefore ETF's and Funds raise the demand additionally

Risks:

- high prices in the raw material sector lead to enormous efforts from industry to find suitable alternatives. If the current price development will remain in future, Platinum, which have very similar properties, could be interesting for the industry. But this conversion process will require some time

Conclusion: The experts dont't expect a speedy end of raising prices. But the investors have to deal with high volatility periods. Jeffrey Currie von Goldman Sachs increased his price forecast to 3000 USD per ounce last week. This could be a interesting topic for structered products.

There are also some promising companies which are involved in the exploiting process of palladium:

We developed two efficient structures for you to participate in the Palladium boom. We also involved Gold and Silver to improve the conditions. The first one a Capital Protection Product in USD (98%), the second one a Barrier Reverse Convertibles in USD including a guaranteed Coupon of 6% p.a. and a european Barriere with 69% .

6M/9M/12M Capital Protection Note in USD

| Currency | USD | ||

| Denomination | USD 1'000.-- | ||

| Maturity | 6 months | 9 months | 12 months |

| Underlying (Worst Of) | Palladium Spot $/Oz (XPD CUR) Silver Spot $/Oz (XAG:CUR) Gold Spot $/Oz (XAU CUR) |

||

| Capital Protection | 98% | ||

| Participation | 120% | 120% | 130% |

| Cap | No Cap | ||

| Strike | 100% | ||

| Indication | 28.01.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Retro on Demand | ||

12M Barrier Reverse Convertible in USD

| Currency | USD | ||

| Denomination | USD 1'000 | ||

| Maturity | 12 months | ||

| Underlying (Worst Of) | Palladium Spot $/Oz (XPD CUR) Silver Spot $/Oz (XAG:CUR) Gold Spot $/Oz (XAU CUR) |

||

| Coupon guaranteed with EU Barrier 69% |

6.00% p.a. | ||

| Observation | In Fine | ||

| Indication | 28.01.2020 | ||

| Size | [CCY] 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Retro on Demand | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products. .

Text und analysis by Florian Franz

Partner at Carat Solutions AG

The chart provides you the development of the relevant underlyings during the last 12 months: