Participation Products

Outperformance Certificate

If the underlying increases, usually the price of the corresponding participation products increases as well. If the underlying falls, usually the price of the corresponding participation products falls as well. Often the participation products have no limited lifespan which is indicated by the suffix "Open End". In addition, the issuer risk must be taken into consideration with all participation products, since the capital invested could be lost if issuer becomes insolvent – irrespective of the performance of the underlying asset.

Market expectation

- Rising underlying

- Rising volatility

Characteristics

- Participation in development of the underlying

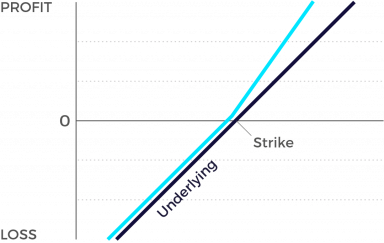

- Disproportionate participation (outperformance) in positive performance above the strike

- Reflects underlying price moves 1:1 when below the strike

- Risk comparable to a direct investment into the underlying

Graphic

Outperformance certificates: Outperformance certificates enable you to participate disproportionately in price advances in the underlying instrument if it trades higher than a specified threshold value. To that purpose, these certificates are equipped with a strike price and a participation factor. The participation factor kicks in only once the strike price has been exceeded and most often lies – depending on the term to maturity and underlying instrument – between 120 and 200 percent. In return, you waive the right to receive dividends on the underlying instrument. When buying one of these structured products, you should make sure that the price of the underlying instrument is not already far above the predetermined strike price; this is because – as we’ve frequently mentioned – leverage is a door that swings both ways, and in such an instance you’d be bearing a greater risk of loss. Outperformance certificates are suited only to investors who anticipate rising prices.