Participation Products

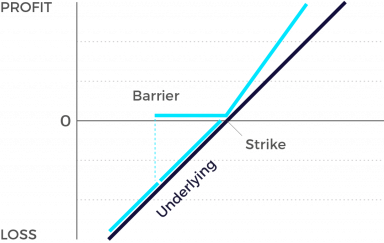

Bonus Outperformance Certificate

If the underlying increases, usually the price of the corresponding participation products increases as well. If the underlying falls, usually the price of the corresponding participation products falls as well. Often the participation products have no limited lifespan which is indicated by the suffix "Open End". In addition, the issuer risk must be taken into consideration with all participation products, since the capital invested could be lost if issuer becomes insolvent – irrespective of the performance of the underlying asset.

Market expectation

- Rising underlying

- Underlying will not breach barrier during product lifetime

Characteristics

- Participation in development of the underlying

- Disproportionate participation (outperformance) in positive performance above the strike

- Minimum redemption is equal to the strike (Bonus Level), as long as the barrier has not been breached

- If the barrier is breached the product changes into a Outperformance Certificate

- With greater risk multiple underlyings (“Worst-of”) allow for a higher bonus level, a lower barrier or a higher level of participation in the underlying

- Reduced risk compared to a direct investment into the underlying

Graphic

Outperformance-Bonus-Zertifikat: The newly introduced “outperformance bonus certificate” combines the strengths of both outperformance and normal bonus certificates. This means that you’re protected on the downside by a bonus level (i.e. a feature of bonus certificates) but nevertheless have the opportunity to participate disproportionately in upside gains in the underlying instrument (the “outperformance certificate” dimension). If you compare all three structured product types with each other, you’ll see that outperformance bonus certificates come up a bit short in terms of the characteristics of the other two forms. In other words, the disproportionate participation rate (outperformance) is usually somewhat lower than with a “plain vanilla” outperformance certificate. This is because additional bonus protection has to be bought in order to structure the product properly. The same applies to the bonus dimension: because such a certificate still affords disproportionate participation, its downside protection level is more modest. Here, the investor expects the price of the underlying instruments to rise, but nonetheless wants to have a certain degree of capital protection (knock-in) if the price were to decline.