Participation Products

Twin-Win Certificate

If the underlying increases, usually the price of the corresponding participation products increases as well. If the underlying falls, usually the price of the corresponding participation products falls as well. Often the participation products have no limited lifespan which is indicated by the suffix "Open End". In addition, the issuer risk must be taken into consideration with all participation products, since the capital invested could be lost if issuer becomes insolvent – irrespective of the performance of the underlying asset.

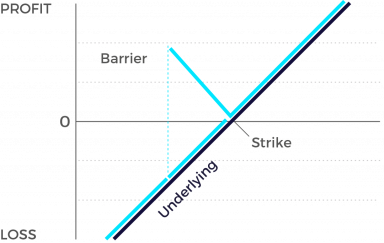

Market expectation

- Rising or slightly falling underlying

- Underlying will not breach barrier during product lifetime/ at maturity

Characteristics:

- Participation in development of the underlying

- Profits possible with rising and falling underlying

- Falling underlying price converts into profit up to the barrier Minimum redemption is equal to the nominal provided the barrier has not been breached

- If the barrier is breached the product changes into a Tracker Certificate

- With higher risk levels, multiple underlyings (“Worst-of”) allow for lower barriers

- Reduced risk compared to a direct investment into the underlying

Graphic

Twin-win certificates: The name already suggests the result – with a twin-win certificate, you can actually have it both ways. In other words, this type of structured product generates a profit for you not only when the price of the underlying instrument goes up, but also if it declines to a certain extent. And this with a specially built-in safety mechanism. The unique structure of these products makes it possible to turn a modest loss in the underlying instrument into a modest gain. Talk about «having your cake and eating it, too»! Twin-win certificates are suited to investors who are convinced that the underlying instrument has a good chance of going up. If it in fact does, the built-in leverage of the product enables you to participate not just 1:1 in that upside move (as would be the case with a normal tracker certificate), but instead at a disproportionate rate and with no price limitation. Great. So what happens when «unexpectedly» the price of the underlying instrument retreats? Well, in that case, the losses recorded down to a specified «barrier level» are converted into profits. The catch: for that to occur, the barrier level may never be so much as touched, let alone violated, during the certificate’s entire term to maturity. If by expiration there has never been a breach of the barrier, you’ll receive cash payment of the difference between the closing price of the underlying instrument and the level where it stood on the issuance date. And another devil in the details: if at any point the price of the underlying instrument does drop below the barrier, you’ll then participate only linearly (i.e. not disproportionately) in future price developments of the underlying stock or index through to maturity of the certificate. If you’re catching our drift here, this means that you might have to swallow a loss if the underlying instrument fails to recover after the barrier has been breached. But you can rest assured that your twin-win certificate will never perform worse than the underlying Instrument.