Leverage products

Constant Leverage Certificate

Leveraged products are financial instruments that enable traders to gain greater exposure to the market without increasing their capital investment. They do so by using leverage.

Any financial instrument that allows you to take a position that is worth more on the market than your initial outlay is a leveraged product. Different leveraged products work in different ways, but all amplify the potential profit and loss for a trader.

Leveraged products will almost always require you to pay an initial portion of the position you intend to open. This is called the margin.

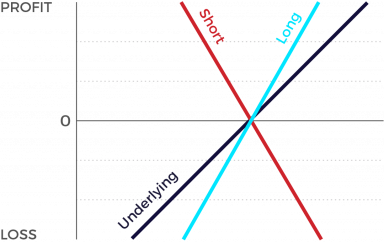

Market expectation

- Long: Rising underlying

- Short: Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- A potential stop loss and/or adjustment mechanism prevents the value of the product from becoming negative

- Frequent shifts in direction of the price of the underlying have a negative effect on the product performance

- Resetting on a regular basis ensure a constant leverage

- Continuous monitoring required

Graphic

These instruments allow investors to leverage rising (long) or falling (short) prices. The selected leverage, which is constant on a daily basis, grants disproportionately high participation in price changes in the underlying. Unlike knock-out warrants and mini-futures, constant leverage certificates do not have a knock-out barrier. In addition, the implied volatility of the underlying does not influence their price. Furthermore, the products have an unlimited (open-ended) term and are not subject to a loss of time value. The benefits at a glance: Simple functioning Disproportionate participation at a set factor Transparent price formation No influence of volatility Open-ended.