Capital Protection

Capital Protection with Participation

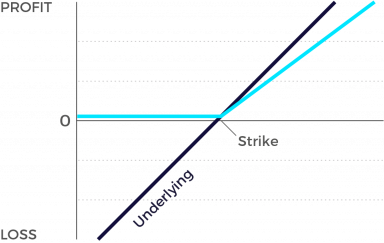

Capital-protected products without a cap offer a guaranteed repayment of principle (upon maturity) as well as the opportunity to participate in price gains of the underlying instrument. However, owing to the guarantee, the participation rate is normally lower than what you’d realize by owning the underlying security outright. There are exceptions in this regard, for example in the case of index-based products for which the issuer can finance all or a part of the guarantee by means of the dividends received.

Market expectation

- Rising underlying

- Rising volatility

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during its lifetime

- Participation in underlying price increase above the strike

- Any payouts attributable to the underlying are used in favour of the strategy

Graphic

Within the certificates family, capital-protected products are the most secure form of investment. At the time of issuance, they’re most often equipped with a term of several years and the guarantee that a specified minimum amount will be repaid at maturity (usually 100 percent of the issuance price). A basic rule of thumb for these products: the lower the safety threshold, the greater the chance for price gains. But an important thing to bear in mind is the fact that the capital guarantee is normally only applicable at maturity. So if you want to sell your capital-protected product prior to the end of its term, the redemption price could actually be below the guaranteed repayment level if the underlying security has not performed favorably. Capital-protected products are suitable for particularly risk-averse investors who wish to hold the product through to maturity and are not prepared to accept any loss that might exceed the level of the guaranteed repayment.