Week 17: Global Indices as Outperformance and BRC

Indices as Outperformance or BRC

In week 17 we present you two interesting products with the following indices as underlyings:

The Outperformance Certificate is aimed to investors which assume that there will be significant rising rates of the underlyings within the maturity. They would like to use this situation with a leveraged product. This certificate is further equipped with reduced participation (80%) in case of decreasing prices.

6M/12M/18M Outperformance Certificate on Indices in CHF

| Maturity | 6 months | 12 months | 18 months |

| Currency | CHF | ||

| Denomination | 1000 CHF | ||

| Underlying (Worst of) | Euro Stoxx 50 (SX5E) Nikkei 225 (NKY) S&P 500 (SPX) SMI (SMI) |

||

| Participation up | 170% | 190% | 215% |

| Participation down | 80% | 80% | 80% |

| Indication | 22.04.2020 | ||

| Size | CHF 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon request | ||

Redemption (12M)

| Performance worst-of | Redemption |

| +50% | 195% |

| +20% | 138% |

| +-0 | 100% |

| -25% | 80% |

| -50% | 60% |

The Barrier Reverse Convertible is aimed to investors which would like to benefit from guaranteed coupons within the maturity. They are uncertain about the precise development of the underlyings. Therefore this risk adjusted structure is equipped with a low European Barrier with 69% or a leveraged Put Strike 80% .

6M/12M/18M Barrier Reverse Convertible on Indices in CHF

| Maturity | 6 months | 12 months | 18 months |

| Currency | CHF 1'000 | ||

| Denomination | CHF 1'000 | ||

| Underlying (Worst of) | Euro Stoxx 50 (SX5E) Nikkei 225 (NKY) S&P 500 (SPX) SMI (SMI) |

||

| Coupon guaranteed with European Barrier 69% |

8.84% p.a. | 9.05% p.a. | 8.12% p.a. |

| Coupon guaranteed with Put Strike 80% |

5.40% p.a. | 6.05% p.a. | 5.88% p.a. |

| Observation | Quarterly | ||

| Autocall | after 3 months 100%; each period decreasing -2% | ||

| Indication | 22.04.2020 | ||

| Size | CHF 1'000'000;-- | ||

| Issuer | Rating A- minimum | ||

| Issue Price | 100% | ||

| Finders Fee | Upon Request | ||

We are happy to customize the relevant components exactly to your personal preferences. Please imagine that the indications can change day by day.

Are you interested in this topic? Please contact us and we will replicate your personal market view "tailor made" with our innovative products.

Text und analysis by Florian Franz

Partner at Carat Solutions AG

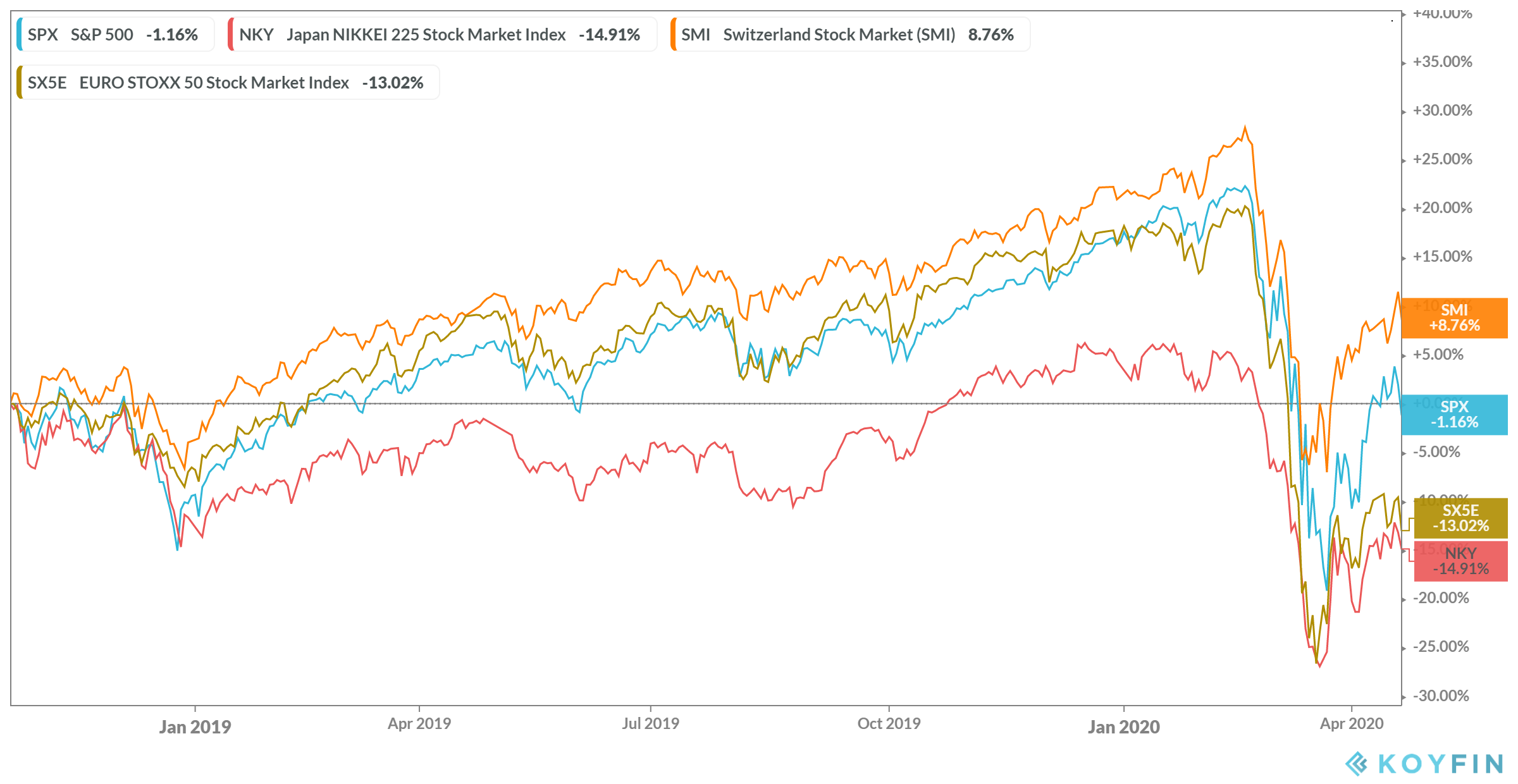

Please find below the chart with the development of the relevant underlyings during the last 18 months: